These key developments will drive industry forward in the new year and, in one case, “taxi” to new heights.

January 4, 2023

As the world, including China, emerges fully from the COVID-19 crisis, and the auto sector overcomes supply-chain issues and constraints in the availability of critical components, could it be that a sense of pre-COVID normality may ensue? And what of electrification on the road and in the sky? Here’s our take on key automotive and mobility developments anticipated in 2023.

Will the chip shortage be resolved?

|

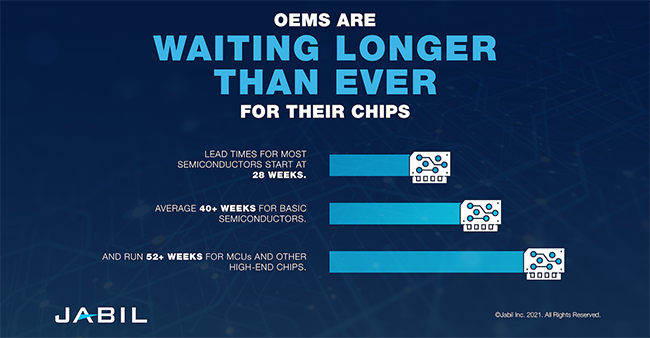

2022 was a tough year for sourcing semiconductor chips, which are increasingly important in all manner of feature-laden and electrified vehicles. In many cases, OEMs had to shut down their assembly lines on account of supply constraints. Will 2023 be any better and give Tier suppliers and molders more stability? According to Graham Scott, Vice President of Global Procurement at electronic manufacturing services (EMS) provider Jabil, “Despite headlines to the contrary, we are not experiencing an end to the global semiconductor shortages. Based on market data and conversations with our customers, we expect the basic semiconductor market to be constrained well into 2023, at least; the market for complex semiconductors — microcontrollers, microprocessors, and field-programmable gate arrays (FPGAs), to name a few — will be tight throughout 2023,” said Scott. “A few segments in particular are fueling the current spike — the growth of the internet of things (IoT), 5G, and automotive, especially the electrification of the automotive industry,” he added.

VTOLs: Up, up, and away

|

California-based Joby Aviation is developing an all-electric vertical take-off and landing aircraft. |

Our first hotly anticipated development in 2023 was also one of our hot topics last year: Vertical take-off and landing (VTOL) taxi services deserve a mention for the year ahead. Volocopter of France, China’s AutoFlight, aerospace giant Airbus, US-based Joby Aviation, a partnership of Boeing and Wisk Aero, and Chinese venture company Ehang are in various stages of development of electric ride-sharing, autonomous, and single-seater flight technologies, with mass roll-outs beckoning. Composites converters will relish higher volumes and a sustainable revenue flow.

Hushing up EVs

The Toyota Prius, and EVs and hybrids in general, can be difficult for pedestrians to hear approaching, hence the virtual engine sound that hums at low speeds and in reverse. Drivers may find this “spaceship hum” annoying, and they also may find noise-vibration-harshness (NVH) more apparent without the masking effect of an internal combustion engine. Materials supplier Celanese is debuting next-generation polyamide resins to dampen noise at the chassis and suspension level to address these concerns. Others are expected to follow.

EVs to make inroads in America?

|

Mass production of Tesla's troubled Cybertruck is slated to begin at the end of this year. |

EV sales in 2021 accounted for 86% of the Norwegian market in 2022, followed by Iceland (72%), Sweden (43%), the Netherlands (30%), France (19%), Italy (9%), and Spain (8%) ,according to the International Energy Agency. In the United States, meanwhile, sales of 630,000 vehicles in 2021 corresponded to a 4.5% market share. Could 2023 be a breakout year for SUV- and light-truck-loving America? In 2023 a fleet of new pickup truck models will join existing offerings such as Ford’s F-150 Lightning (incidentally the hybrid version of the F-150 was named the worst performer in Consumer Reports 2023 owner survey) and the R1T from Rivian. These include an electric Chevrolet Silverado and Tesla’s oft-delayed Cybertruck. With fuel prices much cheaper in the United States versus Europe, however, it may be a long and winding road to high levels of electrification.

Battery recycling on a roll?

|

Redwood Materials plans to build an EV battery recycling plant, shown here in a rendering, near Charleston, SC. |

Lithium, cobalt, nickel, and manganese are costly inputs for EV batteries, with limited supply options, some of them with questionable credentials. The Democratic Republic of Congo, for example, accounts for 70% of global cobalt output, followed by Russia with a less than 5% share. It’s only natural, therefore, that the battery industry is eager to recycle as many spent batteries as possible.

Electrification is projected to increase lithium-ion demand more than 500% by 2030, according to Redwood Materials. “The supply chain is unprepared to support that growth.” The company is developing a closed-loop, circular domestic supply chain by recycling and refining lithium-ion batteries and remanufacturing anode and cathode components. Battery recycling is also coming to North America through a major investment by LG Chem and technical partner Jae Young Tech. And with localization of battery manufacturing in the United States, converters will be well placed to supply higher levels of housings and other plastic components.

About the Author(s)

You May Also Like