Sponsored By

Automotive & Mobility

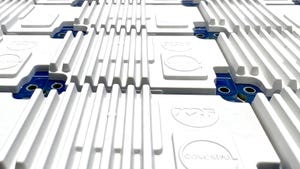

Luran S XA SPF60 acrylonitrile styrene acrylate

Automotive & Mobility

ASA Resin Generates Deep Black Effect for Automotive ExteriorsASA Resin Generates Deep Black Effect for Automotive Exteriors

Leading European automotive brand specifies Ineos Styrolution’s Luran S XA SPF60 for blackening panels of its line of trucks.

Sign up for the PlasticsToday NewsFeed newsletter.