TESco Associates (Tyngsborough, MA) is not your normal plastics injection molding operation.

September 10, 2012

TESco Associates (Tyngsborough, MA) is not your normal plastics injection molding operation.

The entire working supply of resin compounds is kept in a smallish room in refrigerated plastic bags that each are valued at thousands of dollars. Every piece of primary and secondary processing equipment is highly customized, often with proprietary modifications. When new equipment is installed, suppliers are told to send only one technician, preferably one the company already knows. Five hundred parts may be a large annual run for the life of a product. Every part is inspected with a microscope. There are more than twice as many people working in quality control than in production. There are no outside sales people. And the product development cycle is many years.

|

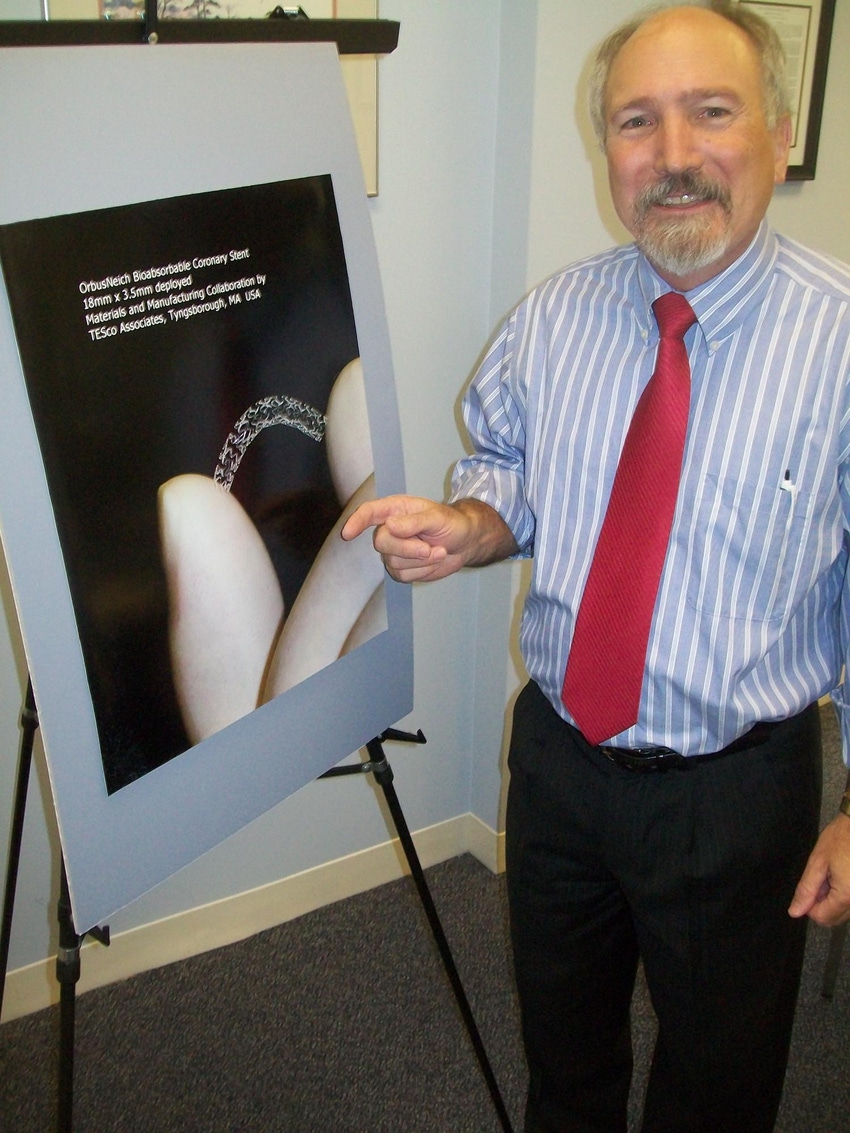

Larry Thatcher discusses bioresorbables. |

At the helm is president G. Lawrence Thatcher, who founded the company in 1980, as a plastics engineering consultancy while he was on the faculty at UMass Lowell. Five years later he gave up his faculty position, bought his first injection molding machine and in 1996 he made a decision to focus his business on the development and manufacturing of bioresorbable implantable medical devices, such as fasteners, stents and scaffolds.

Today he operates 12 clean room suites (no tents here) in a 10-year-old 15,000 square foot facility that looks like a medical lab. He operates five injection molding machines and two extruders. TESco Associates measures capacity by screw size: they're in the 12 to 20 mm range. Screws are especially designed for bioresorbable compounds and sometimes they are designed just for one job.

"Our growth has been very steady, but slow," Thatcher said in an interview with Plastics Today. "We have even had growth, or at least had no layoffs, during recessions, because smart medical device companies want to make sure they have products ready to come out of the tunnel when the economy improves."

This is a boutique, very high-value business.

There are only two principle global suppliers of high molecular weight bioresorbable lactide and glycolide polymers with an inherent viscosity greater than two (melt processable). Those two companies are Purac, which is building a U.S. plant for its very pure lactide products, and Evonik, which last year bought the Resomer business of Boehringer Ingelheim Pharma GmbH & Co. TESco buys from these and other suppliers for polymers used in its specialty melt process operations.

Materials used for bioresorbable applications include poly-alpha-esters (L-lactide and D,L-lactide), glycolides, polyester ethers (polydioxanone), and polycarbonates (glycolide or lactide-co-trimethylene carbonate), and tyrosine based polycarbonates.

"When medical device companies or entrepreneurs approach us with a new project, we need to determine if there is a material that can be manufactured that will fulfill the intended clinical outcome," says Thatcher.

Not for the faint-hearted

There are potholes everywhere.

There are outstanding new materials being developed, but sometimes they cannot be synthesized on an adequate scale. Processing is a puzzle because each bioresorbable material has different melting kinetics. Special feeding equipment is required. Special controls, special everything. And many materials fail the clinical test.

For example, "Companies like to talk about the radial strength of their bioresorbable stents, but there are many other factors to consider," said Thatcher. One is flexibility of the tiny device as it is being inserted with a catheter through the arterial system, as well as its ability to be stretched oversize. Another is its degradation rate. Another is its absolute purity, requiring special attention to catalysts and other chemicals used in the production process.

As a result, TESco works with its clients to develop the right polymeric compound. Manufacturing, clinical and regulatory issues are all considered. Thatcher said the company has invented or participated in the invention of more than 30 proprietary bioresorbable compounds, and has filed and received several patents on the materials. Specifications sent to materials synthesizers are many pages long.

"One thing that concerns me is that commercial molders see the reports on the predicted size of the market for bioresorbable implants and don't understand that this not a melt-and squeeze business. What we are doing is really the antithesis of what the plastics industry generally does."

Thatcher said that TESco generally cannot compete just on price, and that's a problem at times when purchasing departments require multiple bids. There's a growing recognition, however, of the importance of quality for clinical and legal reasons.

The product development side of TESco's business is separate from the contract manufacturing side. Thatcher expects to pick up the contract manufacturing for new products and has space available for expansion. He also already has permission from local authorities to add 5,000 more square feet of manufacturing space.

One promising project moving closer to commercialization is a bioresorbable stent under development with OrbusNeich (Hong Kong), which does its advanced R&D in Ft. Lauderdale, FL. Thatcher has three patents on polymer technology developed for the stent system.

Reinforcements are coming

Thatcher sees two significant emerging trends in the bioresorbable medical implant business.

One is growing use of biocomposite materials. "There is a need for more reinforcement for load-bearing applications," says Thatcher. "That has been a major shortcoming to date." Materials used for reinforcement include nanoscale bioceramic and bioglass. If they don't fully biodegrade, they become part of an internal structure, such as a scaffold, that provides strength where needed.

Another major development will be increased use of implantable scaffolds, often in conjunction with tissue engineering.

TESco Associates is a small operation-just 23 people. But the supplier network engaged in any particular project is huge. The company's approach shows the pivotal role plastics specialists are playing in the major changes taking place in medical care.

You May Also Like