Sponsored By

Injection Molding

quality dial

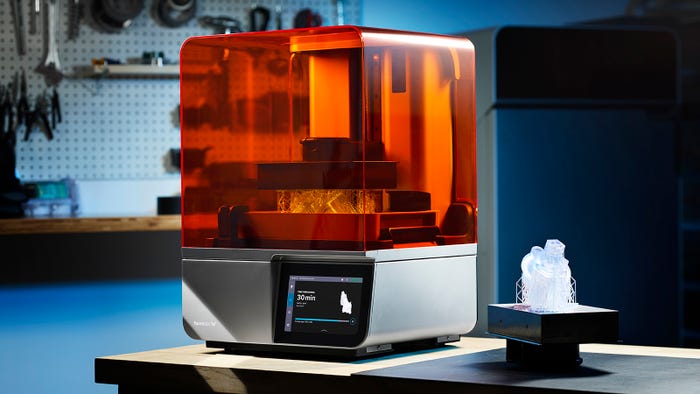

Medical

How to Optimize Your Medical Injection Molding ProcessHow to Optimize Your Medical Injection Molding Process

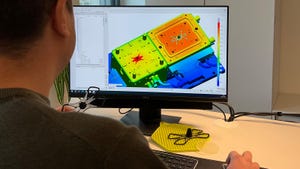

To consistently mold components that meet quality control specs and reduce development hours for customers, follow these steps.

Sign up for the PlasticsToday NewsFeed newsletter.

.png?width=300&auto=webp&quality=80&disable=upscale)