In the most recent survey from Plastics Information Europe, almost a quarter of respondents said they expect to start rebounding from a dismal 2022 in the second half of this year.

February 5, 2023

Gloomy forecasts for the second half of 2022 from members of the plastics industry in Europe participating in a survey in June and July 2022 proved to be prescient, reports Plastics Information Europe (PIE). In the most recent survey conducted by the information outlet for Europe’s plastics industry in late 2022 and early 2023, a little under half of the companies surveyed said that business indeed was worse in the second half of 2022 than in H1. There were some regional differences: More than 81% of respondents from Italy reported a downturn while 55% said so in German-speaking countries.

The hardest hit sectors were plastics recycling — 73.3% reported a decline in business in H2 — and raw materials distribution and compounding, with just under two-thirds of those companies saying their business suffered during that time frame.

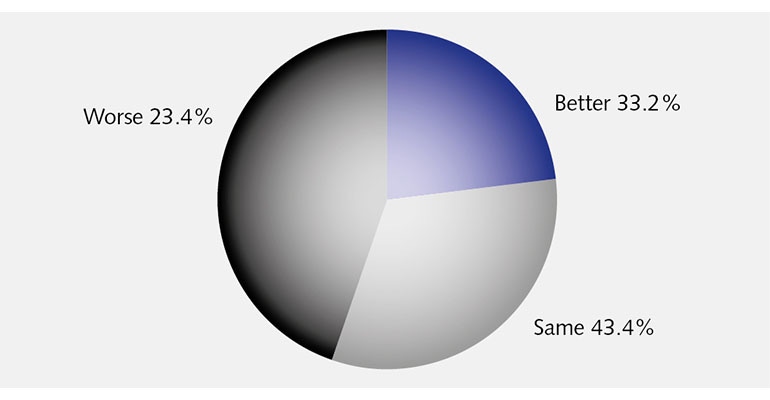

The silver lining in the most recent survey is that a majority of EU plastics companies believe it won’t get any worse. The sunniest expectations are in Spain and Portugal, where 54% of respondents anticipate business to bounce back in the first half of this year. In France and Benelux, 42% of respondents expect to see an improvement.

Also, nearly a third of companies in the survey said they plan to increase capital investment spending this year, compared with a quarter in H2 2022. However, almost 24% in the most recent survey said they were planning to reduce spending in 2023.

Among the top concerns survey respondents faced in H2 2022, not surprisingly, are costs related to materials (80%) and energy (76%). While inflation and the war in Ukraine also weighed heavily, raw material cost has ebbed as a concern going into 2023.

A very small number of companies — 2.4% — believe that they will never return to the level of activity they had before the pandemic. But most of the respondents from German-speaking Europe and brand owners don’t expect to see a full recovery until 2024. Almost a quarter of respondents expect to start rebounding by the second half of this year.

The PIE said that 297 individuals from more than 40 countries participated in the survey, which was conducted between Dec. 5, 2022, and Jan. 13, 2023.

PIE provides business intelligence to Europe’s plastics industry via market reports, resin pricing updates, and company news.

About the Author(s)

You May Also Like