The plastics market should reach the apex of the resin-ridden rollercoaster and into a period of more balanced supply and demand fundamentals.

August 17, 2021

For resin producers in North America, 2021 has truly been a banner year, although those at LyondellBasell, Dow Chemical, and other major producers in charge of resin shipping logistics might have a few words to the contrary.

Still, the recent earnings calls hosted by resin producers have been buoyant to effervescent in tone amid high earnings and robust margins. As is typical of these situations, the presentations were awash with sentiment that resilient consumer demand and disrupted logistics will continue to keep resin supply tight and margins strong.

And that may well be the case — no one really thought we would be having six consecutive months of US polyethylene (PE) contract price increases through July, but here we are. However, absent a major market-moving weather event such as a US Gulf Coast hurricane knocking a hefty amount of polymer production offline, we should be at the apex of the rollercoaster ride that has been PE, polypropylene (PP), and polyethylene terephthalate (PET) pricing over the last several months and headed into a period of more balanced supply/demand fundamentals.

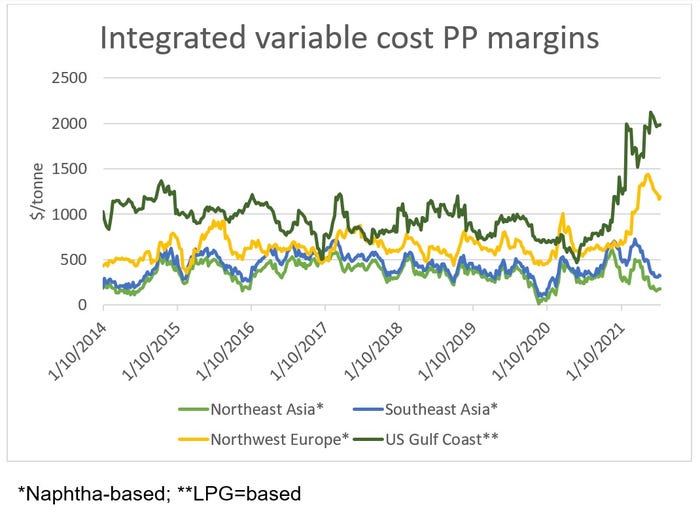

The whats, whens, and whys are numerous and articulated well by my analyst and market editor colleagues at ICIS and Chemical Data (CDI). One reason we are at an inflection point for change is apparent in the chart below, which shows how good business has been for PP producers in the US and Europe and challenged in Asia.

Pre-COVID-19, global PP producer margins stayed in a relatively coordinated band. Disruptions in container shipping brought on by port lockdowns/shutdowns and disjointed demand has made it difficult and extremely expensive to move anything by container from Asia to the US or Asia to Europe. It has regionalized global markets such as PP, but there are signs that the market is trying to rebalance itself. With US prices almost three times the levels transacted in Asia, suppliers there are showing greater willingness to pay high shipping costs to move PP to the US. The ICIS Supply & Demand Database has noted substantial increases in US PP imports in 2021 when compared with 2020 or even pre-pandemic 2019, with increased cargoes arriving from China and South Korea.

Domestic suppliers of PP and other commodity resins will not cede their market share so easily and will ramp up production further as February’s Gulf Coast winter storm gets further in the rearview mirror. That’s only as long as the region dodges a major hurricane.

That should lead to greater days-of-supply inventories, which should take the heat off pricing and bring some relief for converters and brand owners towards the end of this year.

The transition to a more balanced to well-supplied marketplace will be messy — it rarely occurs in an orderly form and tends to pick up momentum as buyers start to feel empowered to push for further discounts in exchange for keeping more volumes with a particular supplier.

Suppliers are very communicative of supply challenges and disruptions and their resulting pricing effect when pricing power resides on their side of the market price setting equation. When the pendulum swings to a buyers’ market, too often buyers still rely on suppliers for their market information or wait too long to lean on non-biased third-party market intelligence such as that with ICIS and CDI. Being a late adapter to market price declines can cost hundreds of thousands of dollars or more in additional procurement costs, which can be especially painful in today’s business environment where inflation pressures are numerous along the supply chain.

Plastics converters and downstream industries need to prepare for the likelihood of a change in pricing power in the next few months and have procurement and communication strategies ready to go when the markets do turn. To shape those strategies, such companies can turn to ICIS and CDI for guidance on market changes as well as data and insight surrounding supply and demand, economic drivers and more.

Just as water always finds its level, so too does supply and demand. Commodity resins are primed to find their level again. Be ready to succeed when it does.

Jeremy Pafford, head of North America market development, drives ICIS’s business development strategy for the US, Mexico and Canada and represents ICIS to chemical and polymer markets to showcase the company’s expertise. Pafford draws upon experience in leading engagement efforts by the Americas team over the last several years.

About the Author(s)

You May Also Like