June 7, 2021

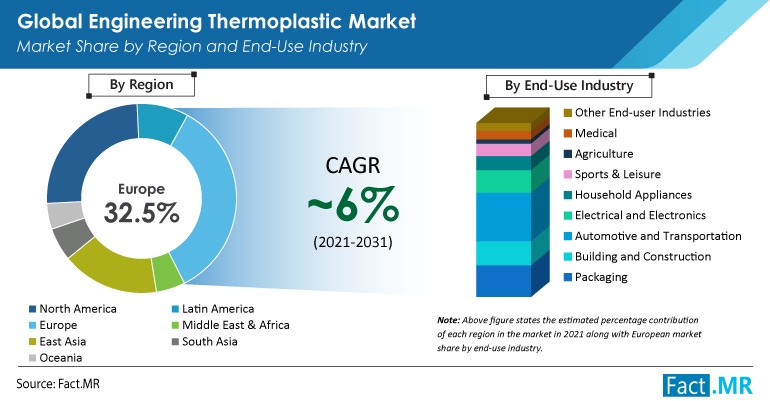

The global engineering thermoplastic market is anticipated to reach a valuation of $259 billion by 2021 and is expected to expand at a healthy CAGR of around 6% over the forecast period of 2021 to 2031.

In 2020, engineering thermoplastics held almost 20% share of the global plastic market. As well in 2020, North America and Europe together accounted for more than half of global engineering thermoplastics market revenue.

Prime factors influencing growth are increasing dominance of engineering thermoplastics in numerous end-use industries such as packaging and automobiles, and availability of bio-sourced plastics as a non-oil alternative source to thermoplastic industries.

That’s according to a new report published by ESOMAR-certified market research and consulting firm, Fact.MR.

Rise in demand for high performance plastics is due to their well-balanced properties of low density, ease of processing, and low cost. Thermoplastics are also suitable for economical processing from low output-specific packaging to mass production. Demand for lightweight along with high waterproof packaging has significantly reduced demand for paper and paper-based packaging and has fueled the market for thermoplastics in packaging.

The sustainability influence.

Plastics have extensively been used in the packaging industry due to their exceptional performance, accounting for over 30% of total materials. Plastic packaging commonly entails thermoplastics, including polyethylene (PE), polyvinyl chloride (PVC), polypropylene (PP), and others. However, around 80% of plastic packaging is discarded every year, which is creating demand for recyclable thermoplastics due to increasing circular economy initiatives.

Utilizing the differences of plastic floatability, flotation can separate mixed plastics that have little differences in density and charge. Electromagnetic identification is another means to separate mixtures of plastic. For example, chlorine scanning is used to separate PET from PVC when the two are mixed.

Similarly, introduction of techniques to separate PET from plastic packaging waste will create an opportunity window for thermoplastic manufacturers. Furthermore, growing use of thermoplastics in fluid handling, medical equipment, and agricultural equipment is likely to create significant demand for engineering thermoplastics, further enabling manufacturers to expand their production capacity in the near future.

Automotive and medical market highlights.

Increasing plastic waste due to ever-increasing demand from the automobile industry is driving the market for recyclable engineering thermoplastic, as people are becoming more conscious towards sustainable living. Emerging markets, especially large markets such as India and China, have significant untapped potential in expanding the market for engineering thermoplastic. As the geriatric population and healthcare expenditure in these nations continue to rise, a greater segment of the world’s population demands better healthcare and treatment with advanced systems. This, in turn, has been creating demand for medical polymers that are primarily used in devices and equipment for hip and joint replacement and spinal implants. Commodity resins such as PE, PP, PVC, PS, and PET are commonly used polymers in medical applications.

Key takeaways from the study.

Semi-crystalline engineering thermoplastic accounts for around 53% of the global sales volume, utilized mainly by end-use industries in Europe.

The European market is expected to offer around a $60 billion absolute dollar opportunity over the next ten years.

The market is highly fragmented, with companies such as BASF SE and Sabic holding around 17% of the global market share.

In terms of end-use industry, the automotive and transportation industry held around 22% market share in 2020.

In 2020, around 30% of the global engineering thermoplastic was demanded and delivered in the form of tubes, to account for $ 75.2 billion market revenue.

The market in East Asia is projected to expand at a CAGR of around 7% from 2021 to 2031.

“Enormous size of BASF SE’s global business allows the chemical and material segment to take advantage of mammoth resources, access to which may not be enjoyed by other players. This is superficial in the company's strong financial standing and diverse product offerings. To tackle the dominance of BASF SE, other key players need to create strong overseas presence. Collaborations and partnerships can result in a competitive,” says a report analyst.

With increase in disposable income, consumers’ buying patterns have reformed, which has been evident due to globalization. Rising population in emerging regions such as South Asia is boosting demand for engineering thermoplastic from end-use industries such as automotive & transportation, electrical & electronics, consumer appliances, and packaging.

During the pandemic, the market for engineering thermoplastic products witnessed a loss in value of $12.7 billion. However, the industry is expected to recover under the V-shape recovery model between 2020 and 2022.

Manufacturers are finding it difficult to source raw materials and maintain revenue along with good levels of profit margins in challenging economies. Therefore, understanding the industry structure and staying connected with the end-use market will not only help understand industry needs but also assist being updated with standard industry requirements. Furthermore, marketing and distribution strategy, minimizing lead time for product availability, along with customer support, strategic collaborations, and partnerships, could be some key winning strategies for manufacturers.

These insights are drawn from the Engineering Thermoplastics Market report from Fact.MR.

About the Author(s)

You May Also Like