In 2013, about 179,000 industrial robots were sold worldwide, representing an all-time high and 12 percent growth over 2012. And China, faced with skyrocketing labor costs, overtook Japan to become the world's largest market, with almost 37,000 industrial robots were sold.

June 16, 2014

In 2013, about 179,000 industrial robots were sold worldwide, representing an all-time high and 12 percent growth over 2012. And China, faced with skyrocketing labor costs, overtook Japan to become the world's largest market, with almost 37,000 industrial robots were sold.

The figures were announced by Arturo Baroncelli, President of industry group the International Federation of Robots (IFR; Frankfurt, Germany) on 4 June at the trade event Automatica in Munich and based on preliminary results of the IFR world robot statistics. "Incoming orders in the first four months of 2014 increased remarkably and requests from all customer industries are on the rise. Therefore, we expect that in 2014 growth of unit sales will continue with the same pace like in 2013," stated Baroncelli.

The plastics and rubber industry took delivery of around 11,500 robots in 2013, which was on a par with shipments in 2012. According to IFR, the main drivers of automation include carbon fiber composites, for which more efficient production processes are required to make them more viable. 1. Other growth drivers include global competiveness requiring increased productivity and higher quality and decreasing life-cycles of products and increasing variety of products requiring flexible automation.

|

Robots for the plastics and rubber industry accounted for approximately 6.4% of overall shipments in 2013. |

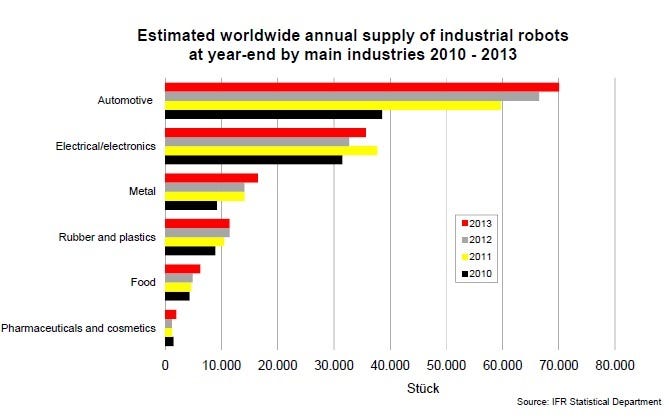

The majority of installations in 2013 were in the auto industry, which took delivery of 70,000 robots. This sector has increased robot investments continuously and considerably between 2010 and 2013, by 22% on average per year according to IFR. The main investing countries involved were China, Germany and the United States. In 2013, robot sales to the automotive industry increased by 5%.

Almost 100,000 new robots were installed in 2013 in Asia/Australia, 18% more than in 2012. The European market increased by 5% to more than 43,000 units almost reaching the all-time-high of 2011. Robot supplies to the Americas continued to increase by 8% to more than 30,000 units. More than 700 industrial robots were sold in Africa, 87% more than in 2012.

Of the almost 37,000 industrial robots sold in 2013 in China, about 9,000 came from local suppliers according to data from the China Robot Industry Alliance (CRIA). Local suppliers' sales volume was almost triple that of 2012. Foreign robot suppliers increased their sales by 20% in China in 2013. Between 2008 and 2013, total supply of industrial robots increased by about 36% per year on average. In 2013, every fifth robot sold in the world was installed in China. Labor costs in China rose by approximately 11% on average in 2013, with a similar rise forecast for this year.

Japan, has more than 300,000 robots in operation, while more than half of the global robot supply of 2013 was produced by Japanese companies. In 2013, sales of industrial robots decreased by 9% to about 26,000 units due to reduced investments of the automotive and the electronics industries in Japan. However, exports of Japanese robots increased.

US reshoring

Robot installations in the United States continued to increase by 6% to a peak level of almost 24,000 units. Between 2008 and 2013, annual sales in the United Sates increased by 12% on average per year. Driver of this growth was the ongoing trend to automate production in order to strengthen American industries active the global market and to keep manufacturing at home, and in some cases, bringing back manufacturing that had previously been sent overseas.

In 2013, Robot sales to the Republic of Korea increased by 10% to more than 21,000 units due to increased investments of the automotive industry. The electronics industry which is the main customer of industrial robots in Korea, reduced its robot orders.

There was a considerable increase of robot installations in other Asian markets especially in Taiwan, India and Indonesia. Also, important European markets such as Italy and Spain started to recover. Robot installations in Central and Eastern European countries as well as in Mexico and Canada continued to increase considerably. The robot market in Brazil lagged behind expectations.

You May Also Like