Sponsored By

Blow Molding

extrusion blow molding (EBM) shuttle

Packaging

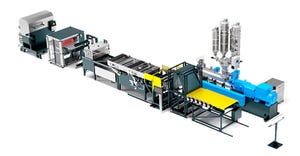

R&B Plastics Highlights Electric Extrusion Blow Molding Shuttle at NPER&B Plastics Highlights Electric Extrusion Blow Molding Shuttle at NPE

The new all-electric shuttle brings a smaller footprint, flexibility, and efficiency to demanding packaging applications.

Sign up for the PlasticsToday NewsFeed newsletter.