With electric vehicle (EV) production set to grow at a compounded annual growth rate of over 80% through to 2017 in Europe and North America, plastics used in these vehicles will also see tremendous growth according to new analysis from Frost & Sullivan (Mountain View, CA). The need to increase EV mileage ranges, paralleled by the inherent advantages of plastics—particularly that of light weight—will drive penetration rates according to the research firm.

June 1, 2012

With electric vehicle (EV) production set to grow at a compounded annual growth rate of over 80% through to 2017 in Europe and North America, plastics used in these vehicles will also see tremendous growth according to new analysis from Frost & Sullivan (Mountain View, CA). The need to increase EV mileage ranges, paralleled by the inherent advantages of plastics—particularly that of light weight—will drive penetration rates according to the research firm.

|

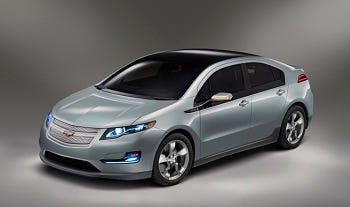

Electric vehicle drive trains open up possibilities for plastics. |

The report, entitled Strategic Analysis of Plastics in the Electric Vehicles Market in Europe and North America, finds that the market earned revenues of $500,000 in 2010 and estimates this to reach $73 million in 2017. The research covers power train plastics, battery casing plastics, thermal management system materials and wire and cable plastic materials.

Frost & Sullivan estimated that just over 200 tonnes of plastics were used in the said applications in 201o and this will grow to more than 23,600 tonnes in 2017. It also rates the degree of technical challenge in serving the market at nine out of ten, while price sensitivity is pegged at six out of ten.

"Plastics for EVs are driven by lightweighting trends which, in turn, are fuelled by the need to improve EV mile range," notes Frost & Sullivan Research Analyst Shree Vidhyaa Karunanidhi. "EVs are typically characterized by huge batteries which add to the overall weight of the vehicle and affect the mile range. To compensate for the battery weight, metals are increasingly being substituted by plastic."

Important structural components such as gears and motors are made of metal. Strength and crash-resistance requirements indicate that metals will remain the preferred material for these applications. However, plastics have huge potential in some of the minor, non-moving components such as energy recovery devices, cooling pipes, pumps, fans, and casing materials.

The current level of penetration of plastics in these components varies. In the case of cooling pipes and fans, plastics are preferred, whereas for other components such as energy recovery devices (pedal and pump) and casing materials, plastics have low to moderate penetration. The inherent features of plastics are, nonetheless, set to push their rapid growth rate in these segments.

"The reduced scope for plastics in EVs in comparison to conventional, gasoline-fueled vehicles poses a major restraint to market prospects," cautions Shree Vidhyaa. "EU end-of-life vehicle (ELV) recycling legislation, which entails the use of recyclable materials, poses another challenge to market participants."

Although thermoplastics used in these cars are recyclable, automotive shredders are typically made up of different types of plastics. These need to be sorted out before they are recyclable.

Therefore, on the one hand there is a need for lightweight cars to improve the mile range in EVs. On the other hand, ELV recycling legislation requires the OEMs to use recyclable materials.

"This issue can be solved if OEMs work with Tier-1 suppliers to develop recycling technologies," advises Shree Vidhyaa. "This will ensure sustainable use of plastics in the long-term." —[email protected]

About the Author(s)

You May Also Like