Sponsored By

News

Bioplastics-NewsStream-FTR-PT.png

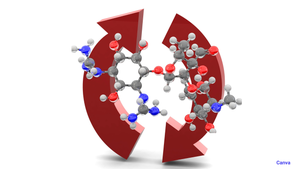

Biopolymers

Bioplastics News StreamBioplastics News Stream

USDA ARS bioplastic update, Ohio Hemp Co.'s biopolymer deal, university pivots to bioplastic, enzyme-quickened biodegradation.

Sign up for the PlasticsToday NewsFeed newsletter.