Sponsored By

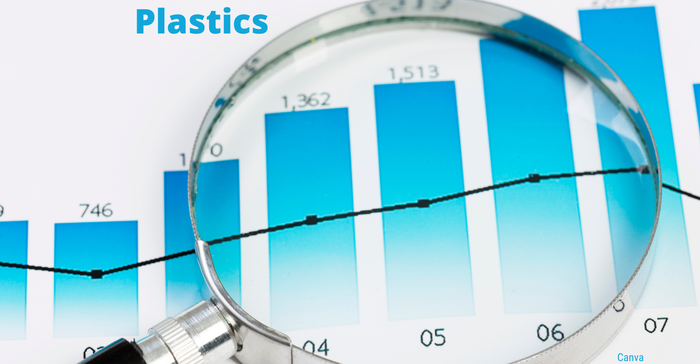

Building & Construction

CAD software on computer screen

Automotive & Mobility

Plastic Part Design: Selecting Appropriate Screw FastenersPlastic Part Design: Selecting Appropriate Screw Fasteners

In the first of this two-part series, design engineer Michael Paloian details key considerations in specifying screw fasteners for plastics, including the type of screw, size, length, and material.

Sign up for the PlasticsToday NewsFeed newsletter.