Packaging is ubiquitous, but the amount of plastic material used for IM packaging has gradually been reduced by downsizing, thin-walling, and eliminating unprofitable brands, partly to reduce costs and partly to be more environmentally friendly.Packaging is considered by many in that segment to be recession-proof, although they won’t say that too loud. Many suppliers to plastics packaging processors confirm that this segment seems to be holding up well, even in the down economy.

April 15, 2009

Packaging is ubiquitous, but the amount of plastic material used for IM packaging has gradually been reduced by downsizing, thin-walling, and eliminating unprofitable brands, partly to reduce costs and partly to be more environmentally friendly.

Packaging is considered by many in that segment to be recession-proof, although they won’t say that too loud. Many suppliers to plastics packaging processors confirm that this segment seems to be holding up well, even in the down economy.

“From an economic perspective, in general, every market is being affected, although packaging is less directly affected overall than some of the other segments we serve,” says Rod Manfull, business director for packaging and containers at color additive supplier Americhem Inc. (Cuyahoga Falls, OH).

|

Plastic packaging is anticipated to outpace paper through 2012, according to a recent report from The Freedonia Group, a Cleveland, OH-based industry research firm. In selected packaging markets where paper and plastic compete, plastic’s overall volume share will continue to expand, reaching 49% by 2012. This percentage, however, understates its share since less plastic is required than paper in most applications due to its lighter weight.

Plastic’s share of the market will expand more slowly than in the past decade, as a number of packaging applications are now fairly mature in terms of the share controlled by plastic. Nonetheless, material enhancements enable extended shelf-life and increased durability, along with reduced material requirements.

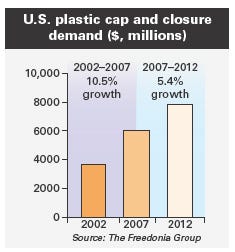

A Freedonia report states that U.S. demand for all caps and closures will reach $9.6 billion in 2012, representing an annual increase of 4.9% and more than 276 billion units. Plastic caps and closures are by far the largest industry segment and will expand at an above-average annual rate of 5.4% through 2012, benefitting from the ongoing supplantation of metal and glass containers by their plastic counterparts in many food and beverage applications. Gains will be bolstered by the popularity of value-added designs such as child-resistant and dispensing closures, with the latter offering increased convenience and controlled product release.

Ease of use in dispensing liquid pharmaceuticals and nutraceuticals is a primary consideration for dosing, for children in particular, and also the elderly. For example, Brad-Pak Enterprises (Garwood, NJ) launched its newly patented dispensing closures that give controlled, directional pouring for pharmaceutical and nutraceutical liquids. A small, triangular “beak” underneath the cap gives precise directional pour.

Overall, U.S. demand for plastic containers through 2012 will advance 5.4% annually to nearly $32 billion, creating demand for 15.7 billion lb of resin. Plastic’s advantages continue to bolster this market, including light weight, shatter resistance, design flexibility, clarity, strength, and effective barrier properties.

Also, unit expansion for plastic containers will outpace volume increases as a result of consumer preferences for smaller, single-serving containers in large markets like food, said The Freedonia Group’s report.

No piece of cake

IM packaging can be found in an array of applications, from food containers to consumer products, medical and surgical devices, and cosmetics, but it’s not without its challenges. Pete Prusak, director of market development, North American Packaging for Clariant Masterbatches (Holden MA), notes that for custom molders, entering this market is becoming increasingly difficult. He says that larger OEMs seem to prefer working with larger, packaging-dedicated molders that can provide a global supply chain. “If the OEM wants to have a cap qualified in Shanghai, for example, they’ll go to a global molder that can provide that service,” he says.

Plus, a major interrupter for IM packaging is the technology advancements of thermoforming. “It’s intrusive technology because of its cost competitiveness in thin-wall, single-use applications. Thermoforming is definitely having an impact in that market,” he explains.

Trends

Prusak sees a few trends in packaging ahead, including the shift from translucency to opaque colors. “I’ve seen this cycle over the past decade from very chromatic colors to tints, and now coming back into chromatic opaque colors,” says Prusak. “It’s about a two- to three-year trend.”

Another trend is that OEMs are shedding brands very quickly if they are not profitable, explains Prusak. “Before, they’d change the packaging, or make changes to the product or the marketing to try and create demand and make them more profitable. Today, they phase out the unprofitable brands and make changes to the products that are profitable.”

It’s no surprise that “green” packaging continues to be in the forefront of design in some applications. Prusak says that some of the biopolymers like PLA make sense for single-use containers. And don’t forget that additives and colorants need to be biodegradable as well when using biopolymers. Clariant offers Renol-natur color additive masterbatches for bioplastics that meet or exceed the European EN 13432 standard for proof of compostability, and they are produced from natural, renewable sources (primarily plants). —[email protected]

WEB EXTRA

Colorful packaging design made easy

|

To offer package designers a broader palette of color possibilities, color and additive masterbatch producer Ampacet Corp. (Tarrytown, NY) came out with ProBlend, a process-optimizing, single-setting, “color-leveling” additive. It eliminates warped, nonconforming parts and time-consuming, color-specific setups by allowing for a single temperature/speed setting that permits all colors to shrink to the same degree in order to achieve dimensional stability. ProBlend can also deliver savings in packaging, where the reduction of scrap from separate color runs, combined with uniform cycle times, can account for additional packaging cost savings. It reportedly works especially well in PP closures, tubs, and containers.

Another tool, the Color Selector Guide from Americhem, gives designers an instant visual picture of available colors for their product concepts. “We’ve put together about 130 standard colors in the Color Selector Guide, molded in polyester and olefins, that cover the visible spectrum,” explains Manfull. “Designers have a starting point instantly. From there, our scientists can accelerate product development time. We’re offering this to customers and potential customers as a tool for those designers to at least stimulate the design thought process.”

Cosmetics: Holding up pretty well

Cosmetic packaging applications continue to offer opportunities for injection molding. There are a plethora of cosmetics on the market that range from drug store brands to high-end department store names that typically require highly aesthetic, high quality packaging.

“One way to give a product the feel of quality is to increase its weight,” says Prusak. “Metal has gravity or ‘heft.’ In a bottle top, a lipstick tube, or a compact case, for instance, that heavy feeling suggests quality, durability, and value. This impression can be very important in the marketing of personal care products. However, metal parts are often quite time consuming and costly to produce, especially in complicated shapes, so designers increasingly turn to plastics for design flexibility, manufacturing ease, and cost benefits.”

Because plastic packaging can feel lightweight and in some cases cheap, Clariant developed specialty compounds that add weight to polymers for products that require a heavy feel. “These fillers can range from 2.5 to a 7 in specific gravity,” explains Prusak. “While they have been used in plastics for quite some time, we’re taking this to cosmetic companies. Now, with these new heavyweight compounds, cosmetic packaging designers achieve the ease of manufacturing and design freedom you get with plastics combined with the heft of metal. Weight always equals luxury.”

About the Author(s)

You May Also Like