Despite trillions of dollars being invested in bailouts in both the U.S. and Europe, their effect in the coming months can be summed up as too little, too late. The truth is, the United States has been heading toward a recession for the past several quarters. The only thing that prevented it was inexplicable consumer confidence that flew in the face of reason. The strong growth in exports also helped sustain many sectors of manufacturing.

October 20, 2008

Despite trillions of dollars being invested in bailouts in both the U.S. and Europe, their effect in the coming months can be summed up as too little, too late.

The truth is, the United States has been heading toward a recession for the past several quarters. The only thing that prevented it was inexplicable consumer confidence that flew in the face of reason. The strong growth in exports also helped sustain many sectors of manufacturing.

Food and fuel prices were skyrocketing while wages and new jobs remained stagnant or declined, but consumers kept spending. As long as they paid their bills on time, the money kept flowing through the economy. Over the past 15 years the United States has experienced the longest expansion in consumer spending in the last 60 years.

Money flow is to the economy what oxygen flow is to the human body. When major U.S. financial institutions had their liquidity threatened, it was like having the person sitting next to you choking on a hot dog. Perhaps they were acting like a pig and had it coming. Perhaps they should have bit off a smaller piece or chewed the hot dog more carefully. All of these things may be true, but a bigger truth is that if you don't act swiftly to dislodge the hot dog and get oxygen flowing, the lag will cause damage: the longer the lag, the bigger the damage. That's what happened to us with the economy.

Perhaps the financial institutions acted like pigs and should have mapped out a plan a year and a half ago when the first signs of this implosion emerged. Perhaps they should have given Congress the heads up before the situation reached crisis proportions. It's understandable that Congress would balk at spending more than $700 billion without time to really examine the situation and it's understandable that the common reaction was justifiable anger, but most failed to see the urgency of the situation. Cutting off liquidity is like cutting off a person's oxygen supply and the effects of the delay are being felt and will be felt for the next six to 10 months.

The immediate effect was bank failures in the UK, Belgium, the Netherlands, and Germany. At this writing the Economic & Development Committee of the Council of Europe is developing plans similar to those just passed in the U.S. to try to fend off a major depression.

British Prime Minister Gordon Brown has announced that Great Britain will become a shareholder in major banks and has challenged the United States to follow his lead. According to Angel Gurría, OECD Secretary-General, experts for the Council of Europe agree with the U.S. plan to address systemic solutions to keep money flowing throughout the world. To continue the analogy to the human body, we need to focus on keeping oxygen pumping to all the major organs.

We will see tight credit for the next few quarters and a temporary rise in unemployment. These are a natural result of the delay in responding to the crisis. By spring 2009 we should see a stronger dollar resulting in lower oil prices. Housing prices will level off by summer 2009 to prices that reflect the income of their areas. Mortgage will be flowing to families with solid credit and home buying along with all the purchases that accompany a new home will stimulate modest growth in the second half of the year.

WHY THIS REALLY HAPPENED

Television talking heads are blaming everything today on the subprime mortgage crisis. It's easy and we can all agree we hate those guys who spent years filling our e-mail accounts with spam about preapproved mortgages. They make it sound like millions of first-time home buyers were duped by shady lenders and greedy realtors, but statistically those buyers make up a small percentage of the overall crisis. If those buyers were the real problem, it would be an easy fix. The problem is far more complex, goes back further in time, and is sending us into a serious recession.

The real trouble traces back to about 25 years ago when credit card companies went wild recruiting new customers. They were regularly mailing applications to homes, handing them out on school campuses, and recruiting applicants at every major retailer. Millions of people across the country had credit limits far exceeding their annual wages. In 1988 I was earning $17,000 per year, owed $10,000 on my car, and had a stack of credit cards with limits totaling over $30,000. It seemed crazy and it was crazy.

|

Five years ago, personal savings were at a record low and U.S. national credit card debt reached $1.2 billion-that's an average of $4000 for every man, woman, and child in the United States. Personal bankruptcy reached an all-time high and in response the federal government made it far more difficult for consumers to shrug off their debt.

The next phase was to refinance your home to pay off credit cards. This, along with speculators buying multiple homes as investment properties, accounts for most of the failed subprime mortgages. There have been more than $1.2 trillion in subprime mortgages issued. The bulk was second-mortgage loans, and a disproportionate number were made in California. A 2006 report by Fortune's Allan Sloan revealed that the average equity that the second-mortgage borrowers had in their homes was 0.71%. It seems impossible to believe, but it's true; people were borrowing 99.29% of the value of their homes.

Why? Home prices were shooting up and everyone thought they would have plenty of equity in their homes. However, as they were sucking out equity, a rule of thumb that had been used for borrowing since the Great Depression got lost along the way. The old rule was that no more than 20% of your monthly income should go to the mortgage, taxes, and utility payments. When housing prices climbed so high that the average person couldn't find a home for 20% of their take-home pay, buyers were told they could afford to spend 30% of their income on mortgage and taxes.

That formula was inherently flawed because utilities were taken out of the equation and consumers who bought under these conditions were unable to put anything away for a rainy day. Some were even going for gimmick loans that featured low or no-interest loans for the first five years, followed by a balloon payment the borrower could not possibly afford. The plan was to refinance again before the balloon came due.

These are the people who became the bulk of the subprime borrowers (people whose credit ratings did not justify getting a loan). For the most part they were not starry-eyed kids shooting for their first home, but people living from paycheck to paycheck, getting sucked into the quagmire of a second mortgage after a layoff, major illness, or extraordinary expense.

|

These borrowers were relying on credit cards to get them through hard times and rising equity in their homes to pay off debts. These families have no financial cushion and now they are not going to be able to get credit. The only way they are going to be able to build savings is by severely curtailing their spending-the same spending that kept us afloat over the past two years.

Barclays Capital estimates there are 811,000 bank-owned homes in the United States, up from 129,000 two years ago, and predicts that the total will rise 60% before peaking late next year.

AN EXAMPLE WE SHOULD WATCH

California provides a perfect example of why building a nation with a credit card mentality was a bad plan. When the Enron scandal emerged, utility expenses soared. Companies began laying off just so they could pay their electric bills. Rising unemployment led to lower demand in the housing market. Families didn't have rainy-day money saved and unemployment led to them losing their homes. A glut of built homes drove prices down and stalled the new home market. The new home market accounted for a large segment of the economy and without it, unemployment increased among construction workers, continuing the downward trend.

|

If you recall, most of the rest of the country's construction workers migrated to areas hit by Hurricanes Wilma, Rita, and Katrina or were able to transfer their skills to commercial construction. California was one of the few areas where that did not occur and the state's unemployment rate is 7.7%, the third highest in the nation. A vicious cycle began and even though several years have passed, we are just starting to see home prices fall to levels that average families can afford. Once banks loosen their lending, these areas where home prices have leveled off will be among the first to experience economic recovery.

If you think using California as a yardstick for the rest of the country is odd, consider this: California has an economy bigger than most countries ($1.8 trillion) and it accounts for nearly 15% of U.S. GDP.

OUR SOLUTION

First of all, the solution approved by Congress was a solid one endorsed by every major economist. More than half of the world economists surveyed in the past weeks believe this alone will resolve the financial crisis in less than one year. If we see banks stabilize, everything else will fall into place over the next two to three quarters.

Should it fail, how will we get out of this mess? Our solution would be to have the government jump-start the construction industry by investing in the country's deteriorating infrastructure. It has been a little over a year since the horrific I-35W bridge collapse in Minneapolis; and we know that thousands of bridges have been deemed unsafe yet little has been done to address the problem. While we're at it, we could install wind farms on public land to generate clean power as well as jobs.

The Speaker of the House is currently pushing to pass an infrastructure plan as a $150 billion stimulus package. The only problem would be that, if the economy responds as hoped, pouring too many dollars at once into stimulus would create inflation. In economics you can have too much of a good thing and it is important that we wait to see if the bailouts are enough to reestablish balance.

THE GLOBAL ECONOMY

We anticipate global inflation for a minimum of one year, probably more. Since the U.S. dollar is strengthening on the global market, it will lower food and fuel prices. This will help offset the effects on inflation and help consumers in the world's largest economy a bit. This is similar to what we saw in August, where one effect offset another.

Statistics from the U.S. Bureau of Economic Analysis indicate that personal income rose 0.5% in August 2008. However, in August 2008, real disposable personal income decreased 0.9% due to increased prices.

|

On Oct. 7, the International Monetary Fund (IMF) increased its estimate of global losses from the financial meltdown to $1.4 trillion and warned that the world's economic downturn was deepening. Its main concern remains defaults in U.S. housing and commercial real estate. It estimates that over the next several years, central banks will need to slowly inject another $700 billion of capital into the global economy to offset the consequences of these bad loans.

One vocal economist, former managing director of the IMF Michel Camdessus, sees a brighter picture. Camdessus believes that, “thanks to the dynamism of Asia, the global economy will avoid recession.” He thinks Japan will be sucked into recession by its close economic ties to Europe and the United States but the rest of Asia will fare well enough to stave off a global domino effect. Camdessus predicts the global economy will grow about 3% in 2009.

The current IMF managing director, Dominique Strauss-Kahn, also believes the global economy will grow about 3% next year, but for different reasons. He was influential in working with Federal Reserve Chairman Ben Bernanke in coordinating central banks in England, China, Canada, Sweden, Switzerland, and the European Central Bank to lower interest rates concurrently to stimulate lending. Rates in South Korea, Hong Kong, and Taiwan were lower the next day in a show of support after heavy losses hit every major stock market.

Lower rates to attract customers are one thing, but convincing banks they should go ahead and make more loans is another. Should banks freeze at the thought of granting new loans, the IMF and its 185 members are poised to respond. They have already activated their emergency response team and are prepared to respond to emergency requests within two weeks (as opposed to the usual several weeks or even months).

|

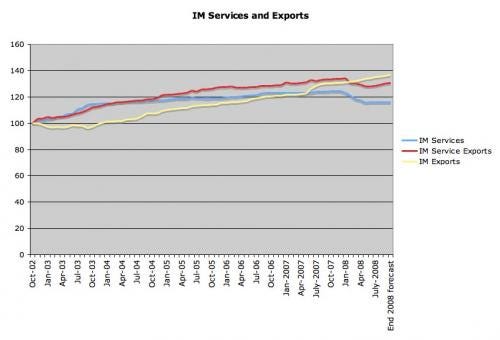

Strauss-Kahn asserts that the systemic plans of the United States, Britain, and central banks will result in a weak 1.6% expansion of U.S. gross domestic product (GDP) in 2008 and a barely positive 0.1% in 2009. But within those figures is a contraction of U.S. economic activity over Q3 and Q4 2008 and Q1 2009, with some stability in the second quarter but sluggish activity through most of 2009. The IMF believes the relatively strong 2.8% expansion in Q2 2008 was skewed by surging exports and the country's economic stimulus package.

Part of the plan to keep money flowing is the U.S. Federal Reserve's decision to buy more than $99 billion in “commercial paper,” commercial loans that are customarily paid back in one week or less. Since the purpose of commercial paper is to help aid liquidity, a shortage in this area would clearly stall the flow of capital.

Also, understand that more than 75% of all the capital invested in the world is invested either in the United States or with U.S. companies. According to MIT's Kristin Forbes, more than $2 billion is invested in the U.S. market each day. Global investors believe in the power of U.S. productivity to generate value and their continued investment will help turn the tide toward recovery.

ECONOMIC INDICATORS

According to Commerce Dept. figures, stockpiles at U.S. wholesalers climbed 0.8% in August, twice as much as forecast, as sales dropped by the most in more than a year. The Commerce Dept. reported that orders for manufactured goods dropped by 4% in August, compared to July. That's a much worse performance than the 2.5% decline that economists had expected. It was the biggest setback since a 4.8% plunge in October 2006. The weakness was led by big declines in orders for aircraft, down 38.1%, and autos, which fell by 10.6%, the worst performance in nearly six years.

September's unemployment rate was 6.1%, up from 5% as recently as April. Expect an average of 74,000 job losses a month for the next 12 months with the unemployment rate reaching 6.8% by June, a level last seen in 1993.

The Fed has reduced the benchmark interest rate to 1.5% and may lower it by another half percent in six months. Some economists have suggested they lower it a full percentage point in the spring if we do not see significant signs of recovery.

Consumer spending accounts for about 70% of all economic activity in the United States. Consumer prices will rise 3.8% in 2008 and a more modest 1.9% in 2009. According to new research from The Nielsen Co., 35% of U.S. consumers across all income levels expect to spend less on 2008 holiday shopping. Only 6% expect to spend more and 50% of consumers surveyed expect to spend the same amount as last year during the holiday shopping season, historically defined as Thanksgiving week through the last week of December. Nielsen's survey of 21,000 U.S. households shows that economic concerns are also putting a damper on holiday spending among high-income ($100,000-plus) consumers, with 32% of affluent shoppers planning on spending less this holiday season. Only 5% expect to spend more.

Nielsen forecasts 4.7% growth in dollar sales or $98 billion across grocery stores, drug stores, mass merchandisers, and convenience stores for the holiday shopping season. The growth forecast, slightly higher than last year's 4.5% gain, is in large part due to higher commodity prices. Nielsen projects unit sales, however, to be flat or down 0.8% vs. a year ago.

Economic activity in the manufacturing sector failed to grow in September, while the overall economy grew for the 83rd consecutive month, according to the most recent report from the Institute for Supply Management (ISM). The Tempe, AZ-based firm says its PMI (Purchasing Managers' Index) indicates a significantly faster rate of decline in manufacturing during September, marking a departure from the 2008 trend toward negligible growth or contraction each month. This is the lowest level for the PMI since October 2001. This month's report is showing prices rising at a much slower rate, as the Prices Index fell to the lowest level in 21 months. Export orders continued to increase, but at a slower rate than in August.

GLOBAL PLASTICS

According to the Society of the Plastics Industry's (SPI) Committee on Equipment Statistics (CES), U.S. manufacturers and importers of primary plastics machinery and equipment shipped $195 million worth of primary machinery (excluding components and auxiliary equipment) in Q2 2008. That's a 12% drop in dollar amounts from the same quarter last year. It's 13% less than the $224 million shipped last quarter. Economist Bill Wood, who provided the analysis for SPI's report, forecasts that “the growth rate in the equipment spending data will stay moderately negative for the remainder of this year, but then investment is expected to rebound in 2009.” Wood hopes to see growth reach 4% by the end of next year.

THE HOUSING AND CONSTRUCTION MARKETS

The National Assn. of Realtors (NAR) reports that August pending home sales jumped 7.4% as a result of pent-up demand and increased affordability as foreclosed homes became available at rock-bottom prices. Pending home sales were up in every region of the United States. August numbers were 8.8% higher than a year earlier and the highest since June 2007. NAR forecasts U.S. existing home sales at 5.04 million this year, rising to 5.41 million in 2009, and new home sales of 503,000 in 2008, falling to 471,000 in 2009. They believe housing starts, including multifamily units, will drop 28.2% to 973,000 units this year, and fall further to 843,000 in 2009 as builders clear inventory.

The IMF predicts U.S. housing prices will fall another 10% before bottoming out, and when that happens, more than 10 million homes will have mortgages higher than the market value of the home.

The credit shortage has delayed or cancelled the nonresidential building projects that had been offsetting losses in residential construction. The loss of only a few percent of planned projects is enough to delay the expected recovery of real construction spending by at least two quarters.

AUTOMOTIVE

At press time for last month's MEI, the big three American automakers were appealing to the U.S. government for a $50 billion bailout. No one thought they could possibly need such a huge sum and Congress approved only $25 billion in below-market-rate loans to the auto industry. Nearly 400,000 automotive jobs have been lost in the past four years and Michigan leads the country in unemployment with its jobless rate hitting 8.9%.

Now a report by J.D. Power & Assoc. indicates the global auto market is at risk of collapse within the next year. “While the global automotive industry is clearly experiencing a slowdown in 2008, the global market in 2009 may experience an outright collapse,” says Jeff Schuster, executive director of automotive forecasting for J.D. Power. The firm forecast U.S. light vehicle sales would fall to 13.2 million units in 2009 after likely settling at 13.6 million units this year, adding that a pronounced recovery is more than 18 months away.

U.S. auto sales totaled 16.15 million units last year. Sales in Europe are expected to fall 3.1% in 2008, led by a 7.5% decline in Western Europe. The report also forecast auto sales in China would grow 9.7% this year, less than one-half of the 24.1% growth achieved in 2007.

September auto sales were the worst in 15 years and American International Automobile Dealers Assn. president Cody Lusk is urging Congress to pass a comprehensive economic recovery package. General Motors Corp. sold a total of 282,806 light vehicles, down 15.6% from 334,974 in the same month last year. Ford sold a total of 120,410 light vehicles in September, down 34.5% from 183,912 in the same month last year. Chrysler sold a total of 107,349 vehicles in September, down 32.8% from 159,799 in the same month last year. Toyota Motor Corp.'s September U.S. sales fell 32.3% to 144,260 vehicles from 213,042 a year ago.

WHERE CAN MOLDERS FIND OPPORTUNITY?

Amid the many pages of government bailout there was one little amendment that spells a bit of relief for molders. It went unnoticed by most, but we caught it.

The package included an eight-year extension of a 30% tax credit for residential homeowners and commercial businesses that purchase rooftop solar systems. It also granted an eight-year extension of the investment tax credit for solar businesses. More importantly, there is no longer a $2000 cap on the tax-credit benefit. The average rooftop solar system can cost $25,000-$30,000 and so homeowners can now get around $9000 back on their investment.

Clearly families are not going to invest in solar power while the economy is in turmoil, but once the tide turns, we expect more and more Americans to band together to end dependence on foreign oil. Let's not forget that OPEC has announced a Nov. 18 emergency meeting to discuss cutting back production to “stabilize” oil prices over the winter. That's just the sort of move to spur on the interest in solar power.

The solar industry sold the government on the tax credits as a way to create more jobs amid an economic downturn. They claim the tax break will create 440,000 permanent jobs over the next 10 years and the injection of $325 billion in private investment in the U.S. solar energy market.

According to a report from Equity Development, photovoltaic production is expected to represent a $40 billion market worldwide by 2010. In the United States, solar presently represents about 0.06% of the U.S. power supply and the national goal is to have solar account for around 10% of U.S. power by 2025.

The United States is behind in producing green merchandise and now is the time to begin cultivating customers for this time next year. Right now Germany produces the most solar voltaic panels and China is trying to compete.— [email protected]

Lisa M. Pellegrino, MBA, is a senior advisor at The Repton Group LLC.

About the Author(s)

You May Also Like