Sponsored By

Injection Molding

Wintriss ShopFloorTracker

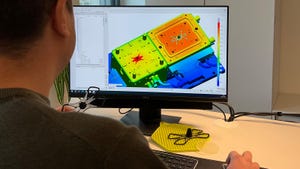

Injection MoldingNew Production Tracker Streamlines Data CollectionNew Production Tracker Streamlines Data Collection

At NPE2024, Wintriss Controls Group will demo its system that tracks a range of inputs with minimal operator involvement.

Sign up for the PlasticsToday NewsFeed newsletter.

.png?width=300&auto=webp&quality=80&disable=upscale)