Sponsored By

News

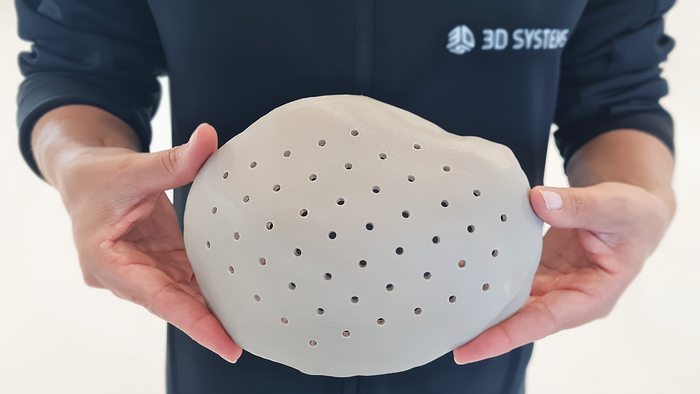

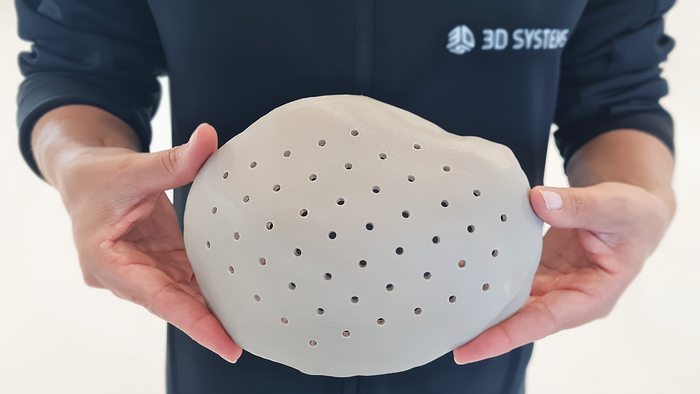

3D-printed PEEK cranial implant

Medical

3D-printed PEEK-based Cranial Implants Cleared by FDA3D-printed PEEK-based Cranial Implants Cleared by FDA

The VSP PEEK Cranial Implant system includes a complete FDA-cleared workflow comprising segmentation and 3D-modeling software, a printer developed by 3D Systems, and PEEK resin from Evonik.

Sign up for the PlasticsToday NewsFeed newsletter.