The outlook for the plastic closures market is looking rosy, as output continues to increase and demand for added value and premium products is more present than ever, according to a recent report from industry consultants, AMI Consulting. Across the pond in Europe plastic closures exceeded 230 billion units in 2014, up from 215 billion in 2010, with the fastest growing market segments being solid food and non-carbonated beverages.In the last couple of years growth prospects have improved along with the economic recovery in a number of European countries.

September 17, 2015

The outlook for the plastic closures market is looking rosy, as output continues to increase and demand for added value and premium products is more present than ever, according to a recent report from industry consultants, AMI Consulting. Across the pond in Europe plastic closures exceeded 230 billion units in 2014, up from 215 billion in 2010, with the fastest growing market segments being solid food and non-carbonated beverages.

In the last couple of years growth prospects have improved along with the economic recovery in a number of European countries.

“Brand owners are looking for a full packaging solution for their products in which the role of closures is increasingly valued, “says Márta Babits, AMI Consulting’s Consumer Packaging Market Analyst. “Well designed closures can improve product differentiation, aesthetics and functionality.â€

“Brand owners are looking for a full packaging solution for their products in which the role of closures is increasingly valued, “says Márta Babits, AMI Consulting’s Consumer Packaging Market Analyst. “Well designed closures can improve product differentiation, aesthetics and functionality.â€

The caps & closures industry is relying more on technological advances with rising levels of R&D investment and technical expertise required. Technology developments enable added value and premium products to be produced at lower cost and faster time-to-market.

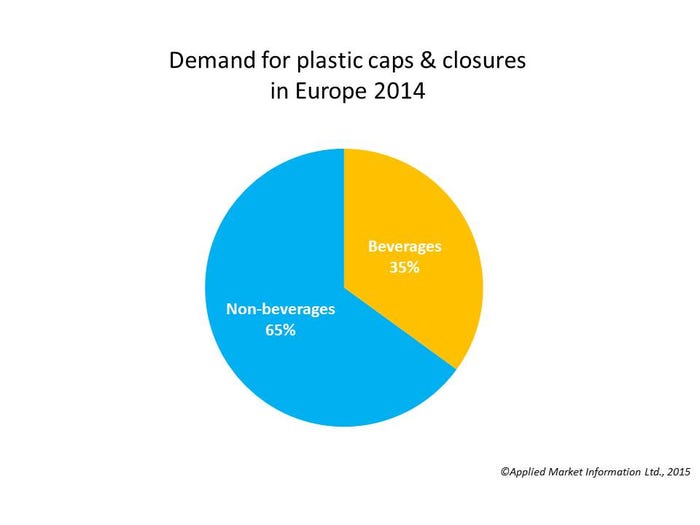

While beverages are still growing, they now account for only 35% of the market, non-beverage applications are growing faster because of added-value and developing niches. The report identifies strong inter-polymer competition between polyethylene and polypropylene with the former gaining in beverages and the latter in non-beverages.

The industry itself is evolving with consolidation underway driven by both organic growth and merges & acquisitions such as 3i Group (London) acquiring Weener Packaging (Weener, Germany) in July 2015. The largest producers in Europe include Alpla (Hard, Austria), Aptar (Crystal Lake, IL), Bericap (Budenheim Germany) and Global Closure Systems (Saint-Cloud, France).

AMI Consulting predicts that demand overall will reach 256 billion units to 2019, a 2% CAGR 2014-2019, but growth in added value products will be well above the average.

“Innovation is gaining importance in protecting and growing profitability and it will create opportunities for well informed and well organised companies,†concluded Babits.

About the Author(s)

You May Also Like