Learn and apply this powerful tool for controlling costs, increasing sales, and improving margins -- and outperform and outlast your competitors. Really.

August 9, 2011

Learn and apply this powerful tool for controlling costs, increasing sales, and improving margins -- and outperform and outlast your competitors. Really.

Options give you 'options' (choices) -- lots of them. They open up a wide range of transactions to match your market expectations, purchase and sale requirements and concerns, and risk tolerance. Without options, transactions are limited to buy or sell, now or later - stark choices. Such stark choices are 'gut checks' for suppliers, processors, and customers that - given the economic environment, and fear and loathing of potential buyer's or seller's remorse (i.e. making a 'mistake') among buyers and sellers - significantly contribute to the preponderance of as-needed, short-term only transactions in resins. It doesn't have to be that way and options are key to changing things for the better.

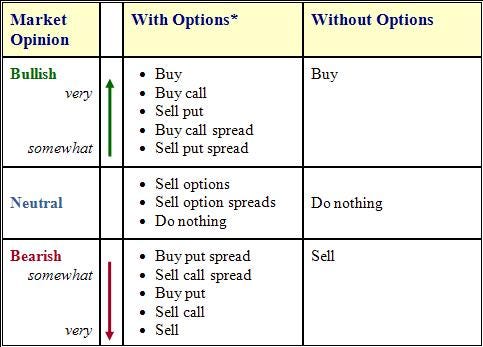

Most successful traders and hedgers understand and utilize options. Some nearly exclusively. The table below shows why, comparing transaction choices -- consistent with a given market opinion (or concern) -- with and without options.

Options chart

* This list is far from exhaustive, as CME options guides (available for download here) demonstrate.

Advantages

Beyond transaction choices and flexibility, options also provide buyers and sellers volume leverage with little capital and risk. For example, the purchase of a near-the-money resin call or put option requires far less capital than an equivalent outright purchase of resins. Equally important, the premium paid for the option is the only capital at risk by the buyer. On the flip side, options sellers have little to no counter-party credit risk because buyers must pay options premiums up-front. Buyers cannot renege on options transactions, and unless the option is in-the-money at expiration, sellers have collected (in the premium) all the money they are due in the transaction.

Resins Options

Currently, options are not available alongside the existing CME resins futures contracts. (Futures options become available once sufficient open interest and trading volume are established in a futures contract.) Options in resins must be transacted in the over-the-counter (OTC) market. Alternatively, depending on the objective, options in highly correlated commodities like crude oil futures may provide the same benefits as options in particular resins.

Since resins options are OTC-only, premiums must be calculated. Fair valuations may be obtained with historical pricing data and a good options valuation program, available at Hoadley Trading and Investment Tools.

Pricing Choices

Several posts in 'Price Wise' have discussed offering pricing choices to customers to increase margins and sales. Two powerful choices are the fixed price with a floor and the capped price. The 'floor' is the strike price of a put option. The 'cap' is the strike price of a call option. You must know options to offer these pricing choices to your customers.

We've only just begun to discuss this powerful hedging and trading tool. Get to know options. Then try them. You and your company - supplier or processor - will benefit immensely, and lose a lot less sleep.

About the author: Tom Langan is a risk management consultant who operates WTL Trading. He specializes in commodity cost control, margin improvement, and revenue expansion for manufacturers and their customers.

About the Author(s)

You May Also Like