Last time, I introduced readers to the resin cost control tools offered by Cargill ETM. IMO, the most advantageous of the tools are options - limited cost & low risk "insurance" against 1) higher resin prices before you lock in a purchase or 2) lower resin prices after you lock in purchase. The first involves price caps (call options); the second involves put options.

November 19, 2012

Last time, I introduced readers to the resin cost control tools offered by Cargill ETM. IMO, the most advantageous of the tools are options - limited cost & low risk "insurance" against 1) higher resin prices before you lock in a purchase or 2) lower resin prices after you lock in purchase. The first involves price caps (call options); the second involves put options. Both are proven economically and strategically beneficial for buyers of commodities and equities. Thanks to Cargill ETM, resins buyers may now benefit from them.

Choices to match

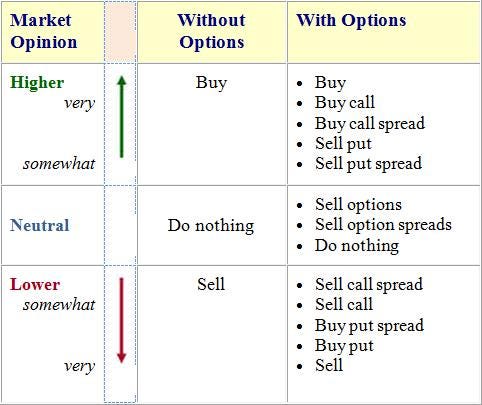

Table 1 from my website shows a range of transactions for buyers or sellers consistent with a given market opinion or concern. Clearly, options provide several more cost and risk level choices than the buy/sell/do-nothing choices without them.

Table 1 |

Profitable Plastics buying options |

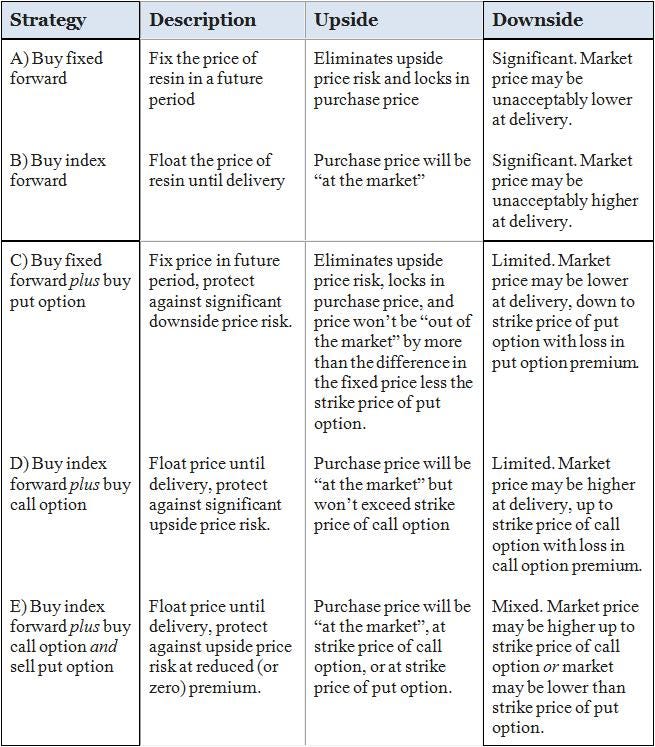

What's the upside and downside for resins buyers of executing one of the above transactions? Table 2 from my website is indicative. Most processors default to strategies A or B; strategies C, D, and E are available with options.

The market isn't the problem

Many processors blame the resins market and, in some cases, suppliers for resin price volatility and resulting costs that exceed expectations or hopes. A supplier says "It [when the discussion turns to price] becomes a combative environment that's not very pleasant."

Volatility is here to stay because resins are petrochemicals and driven by crude oil prices. That's a fact which processors, until now, have had to live with, executing highly risky "fix or float" buying strategies that often lead to market frustration and angst. Now the market (via Cargill ETM and, perhaps, others) offers choices that enable processors to buy smarter and save money and trouble. The sooner processors learn and take advantage of those choices, the better for them and their customers.

Table 2 |

Profitable Plastics options |

Takeaway

Learn and position yourself to execute resin buying strategies C, D, and E above. Then spend more time making better products and meeting customer needs, and less time worrying and complaining about resins prices and profit margins.

About the author: Tom Langan dba WTL Trading is a risk management consultant. He helps manufacturers control resins and other commodities costs, increase revenues, and secure profit margins. Email Tom at [email protected].

About the Author(s)

You May Also Like