Sponsored By

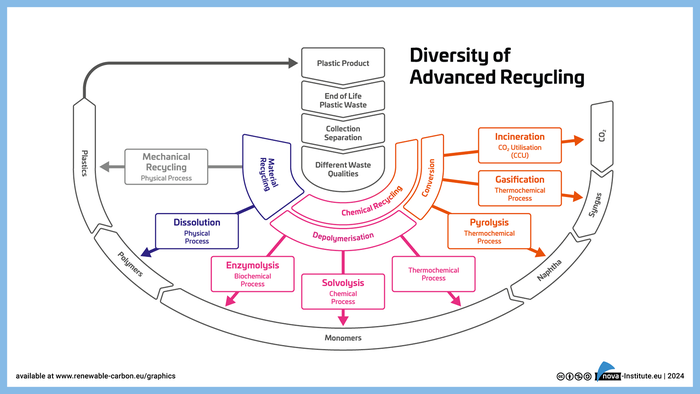

Advanced Recycling

thumbnail

Advanced Recycling

Dow and P&G Partner on Dissolution SolutionDow and P&G Partner on Dissolution Solution

Polyethylene is the target polymer of a novel recycling technology for hard-to-recycle plastic packaging.

Sign up for the PlasticsToday NewsFeed newsletter.