It already looks like 2022 is the year of the recycling initiative.

February 15, 2022

Just about every day, a new partnership, acquisition, technology, or goal related to recycling, sustainability or the circular economy is announced. Some have been quite creative, such as the recently announced Houston Recycling Collaboration partnership of resin producers ExxonMobil and LyondellBasell, chemical recycler Cyclyx International, solid waste manager FCC Environmental Services, and the City of Houston. The coalition’s goal is to increase that major US city’s recycling rate from a current rate of 15% while providing feedstock for the mechanical and chemical recycling streams.

Also, US recycler Evergreen announced in early February a $200 million in investments to expand its recycled polyethylene terephthalate (R-PET) production capacity, with the American Beverage Association and Closed Loop Partners pitching in $5 million jointly for the project.

Just days earlier, Honeywell and Avangard Innovative announced they are collaborating to build a chemical recycling facility at Avangard’s complex in Waller, TX.

The list of announcements will continue unabated this year, understandably so with sustainability goals and plastic waste increasingly topping the agendas of corporate boardrooms, investors, and consumers.

However, full realization of a circular economy will require making it easier for consumers to recycle plastics like PET, polyethylene (PE), and polypropylene (PP), and that’s not done currently.

On the surface, it seems easy to do in my suburban Houston neighborhood, as our solid waste collector provides a recycling bin for single-stream collection. But the list of what plastic materials cannot go in the bin is long as the list that can be.

Milk jugs? Good!

Plastic grocery bags? Nope.

Laundry jugs? Fine, but rinse them out.

Plastic wrappers used for food or other products? Nope again.

Poor polystyrene (PS) boxed out because the polymer name is in the no-entry list without being even labeled by one of its many single-use plastic forms versus expanded polystyrene (EPS).

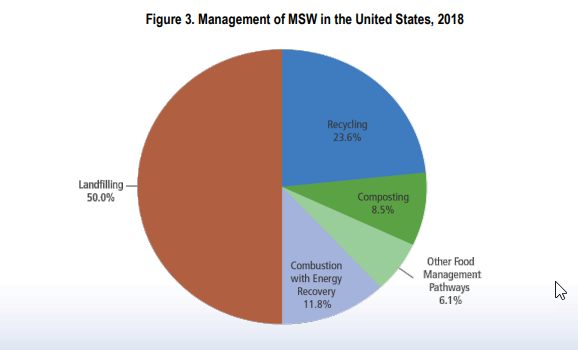

Much focus has been on ramping up capacity and capabilities surrounding mechanical and chemical recycling, and rightfully so, as additional infrastructure is necessary if the US recycling rate is going to increase from nearly 24% (see US EPA graphic below). But building recovered plastics facilities does not solve the logistics of recovering those materials from consumers.

Substantial opportunity to do that resides downstream with brand owners and their manufacturing partners by directly making it easier for consumers to recycle. Takeback programs in particular offer a multitude of benefits to consumer goods companies in that they offer a solution to waste created by their products, keeping them out of the landfill, and keeping the brand owners’ marketing department busy preaching the good word about the companies’ sustainability efforts.

Better yet, if what is being recovered can be recycled or reused into the companies’ products, they also have created a new and circular feedstock stream that can help with supply stability.

That is where converters can and should play a critical role in creating plastic packaging and products that meet the needs of brand owners while also being easy to recycle. Doing so sets the stage for brand owners to create streamlined takeback programs. There already are some good examples in the electronics space from the likes of Dell and Lexmark, but more are needed to help get all those plastic materials shunned by many residential recyclers out of the trash bin and into reuse.

The concern that consumers will not pay a premium for a sustainable product is becoming increasingly outdated, with brand loyalty increasing toward companies that strive for sustainability on the rise.

The plastics industry is well positioned to help foster that customer loyalty, and in the process foster loyalty of brand owners to resin producers, converters, and recyclers.

Jeremy Pafford, head of North America market development, drives ICIS’s business development strategy for the US, Mexico and Canada and represents ICIS to chemical and polymer markets to showcase the company’s expertise. Pafford draws upon extensive experience in leading engagement efforts by the Americas team over the last several years.

About the Author(s)

You May Also Like