Contract decreases may lie ahead, even if the bottom for spot pricing is in place and the low end of the market continues to firm up, according to the PlasticsExchange.

September 15, 2022

The spot resin markets returned to a more active pace following the three-day Labor Day weekend, reports the PlasticsExchange in its Market Update. Buyers began poking around for material on Tuesday, Sept. 6, but nary a fresh Prime railcar was seen from producers, although some off-grade cars flowed and there was ample warehoused material to provide liquidity to the marketplace. Suppliers appeared to pause their chase of low-ball bids, as a bottom in resin pricing might already be in place. While some processors only checked in with the PlasticsExchange trading desk to seek quotes and gauge market tone, this more passive stance by sellers encouraged other buyers actually in need of resin to pony up and pay prevailing asking prices for material. This is a change from the past several months, which saw very aggressive discounting amid mass inventory liquidations while buyers flexed their pricing power, writes the PlasticsExchange.

Compelling buying opportunities for processors

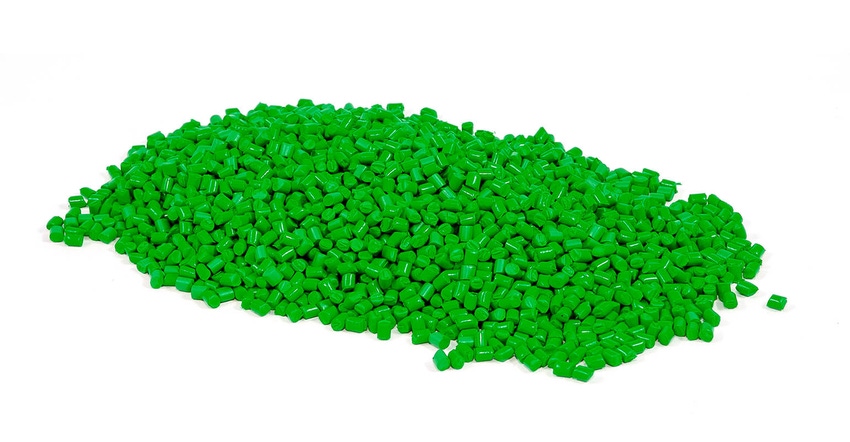

As polyethylene (PE) and polypropylene (PP) prices eroded over the past four months, the range of transactional prices widened. Much of this had to do with resin prices in the different major market segments declining to varying degrees. Branded Prime contracts, which comprise the largest volume component of North American commodity resin sales, has seen the smallest relief, while spot prices, including for both domestic Generic Prime and off grade, fell much more, creating very compelling buying opportunities for processors.

The decline in export prices settled somewhere in between. They never reached the dizzying heights of the domestic spot resin market, and then really plummeted as producers dumped resin into offshore outlets. The past few weeks have seen significant price consolidation in the spot market, as the very low end began to clean up while the top end of the pricing spectrum has come off, as discounted price levels make their way through the industry.

August PE contracts decreased $0.05/lb on average and PP contracts dropped $0.01/lb, which included $0.03/lb of margin contraction. There is a $0.05/lb PE increase on the table for September, which would only be relevant if this year’s benign hurricane season instead brings a large storm through the Gulf to impact petrochemical production.

In the meantime, spot prices remain well discounted to contracts, so more consolidation may be coming. Further contract decreases may lie ahead, even if the bottom for spot pricing is in place and the low end of the market continues to firm up. There are no increases currently nominated for PP contracts, so direction will be dictated by polymer-grade propylene (PGP) monomer costs, which have softened a tad, and whether producers can hold onto their relatively wide margins — a function of supply/demand balance, which still feels heavy.

Rail strike may be averted

On the logistics front, all eyes were once again on potential issues within the rail industry, as unions and rail carriers attempted to negotiate a new labor agreement. Major media outlets reported on Sept. 15, however, that a tentative deal has been reached, thus averting a nationwide strike that could have cost the US economy $2 billion a day. Rail congestion improved somewhat after BNSF Railways lifted its permit embargo in California in late August. Rail carriers were also pulling additional cars out of storage to better serve demand.

Sellers step back from low-ball bids

PE was the dominant resin changing hands the week of Sept. 5, as traders returned in full force after the holiday. PE buyers came looking for material on Sept. 6, and while some deeply discounted offers remained, most sellers took a step back, no longer willing to chase low-ball bids after producers made it known they would be reducing operating rates to shore up the oversupply that has been weighing on the market. The PlasticsExchange reports seeing a noticeable consolidation in prices, as the bottom of the market began to rise and the top end lopped off several cents. Completed business was mostly spread across high-density PE Blow Mold and linear-low-density PE Film and Injection grades. Low-density PE sales were limited.

Railcar offers only trickled in as it seemed that a couple of producers still had some material to move. Most other sellers were silent unless called upon. Overall PE availability is still deemed very good, and time will tell if the heavy export sales and reduced production has begun to truly make an impact, or if there is another proverbial shoe yet to fall, according to the PlasticsExchange.

PP resin trading loses momentum

Spot PP trading did not excite as much as PE. There was a noticeable lack of Prime offers, though off-grade railcars continued to pelt the market, albeit with an uptick in pricing. While the previous week’s busy activity was spurred by lightning-sharp deals and a small increase in demand, last week did not have follow-through momentum, reports the PlasticsExchange. Buyers continued to wait on the sidelines and procure only what they needed to run in the near- to mid-term. Demand for spot truckloads continued last week, and much to the dismay of processors in need, premiums for packaged resin remained relatively large compared with prevailing bulk off-grade deals.

Although overall supply was good, select grades were still difficult to source, such as homo- and co-polymer PP high-flow and co-polymer PP low-flow No Break resins. With monomer coming off a few cents, buyers are expecting some commensurate cost relief, and it will need to be determined if moderating production rates will be enough to shore up the domestic PP market or if additional margin compression will be seen. In the meantime, the peak of hurricane season will pass without much ado, though a late season storm could still come to shock the market like in recent years.

Read the full Market Update, including news about PGP pricing and energy futures, on the PlasticsExchange website.

In other resin-related news

Global PP market forecast to exceed $158 billion by 2030

The global polypropylene (PP) market is expected to expand at a 3.38% compound annual growth rate (CAGR) through 2030, from $122.5 billion in 2021 to $158.2 billion by 2030, according to a business report from Straits Research. North America is predicted to have the fastest growth rate during the forecast period.

Growth is fueled by demand for lightweight polymers in the consumer goods, electronics, and automotive markets, according to the consultancy. PP is also widely used in the medical device sector. Within that market segment, it was valued at $247.7 million in 2018 and is expected to grow in the years ahead.

You May Also Like