Chemicals and plastics supplier Nova’s decision to cease production of its Dylark-brand styrene maleic anhydride (SMA) has created a minor stir among other plastics suppliers who naturally see a void in the market they would like to fill. Nova announced as early as 1998 that it wanted to divest its Dylark business but never did so and in fact kept developing the business until recently.

July 28, 2009

Chemicals and plastics supplier Nova’s decision to cease production of its Dylark-brand styrene maleic anhydride (SMA) has created a minor stir among other plastics suppliers who naturally see a void in the market they would like to fill. Nova announced as early as 1998 that it wanted to divest its Dylark business but never did so and in fact kept developing the business until recently. The company did not openly announce it intended to stop supplying Dylark but Greg Wilkinson, VP public and government affairs at Nova, confirmed to MPW that it is taking its last orders for the material now.

|

Like most material substitution discussions, this one is not as simple as simply replacing one grade of SMA with another grade, notes Uwe Wascher, chairman of the board at Polyscope (Geleen, The Netherlands), which, with Nova’s departure, remains one of the few SMA suppliers able to supply globally. “Our direct competitor was never really Dylark,” he says, “but rather long glass fiber-reinforced polypropylene (GFR-PP).”

Polyscope’s Xiran-brand SMA also competes with materials including GFR-polycarbonate or PC blends, as noted by Bayer MaterialScience (Pittsburgh, PA), Nova’s cross-town rival which supplies these. Once word of the Dylark market retreat was known in mid-July, Bayer pushed out its own press release announcing it was ready to step in and fill the hole left at any Dylark users. The press release indicated that SMA no longer was commercially available: “Now that the SMA material will no longer be available, we can offer a seamless transition for decision makers in need of a replacement material which is available globally for current production of model year interior parts” was a quote attributed to Dave Siler, interiors key account manager at Bayer MaterialScience LLC.

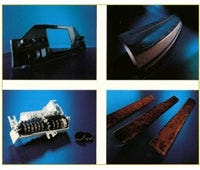

Polyscope’s Wascher naturally disputes the assertion that SMA no longer will be available and says in fact his company is speeding plans for additional capacity, with its most immediate step being to de-bottleneck its sole plant in the Netherlands. “We’d been discussing this (capacity expansion) already. Now, yes, (with Dylark out of the picture) we’re moving a bit faster,” he says. SMA and competing materials see use primarily in automotive applications such as instrument panel retainers, center consoles, and other interior structural parts, with SMA typically used in blends with other plastics to bring these improved properties such as higher heat deflection temperature, but Polyscope’s Wascher anticipates significant SMA demand growth in another end-use market, though he did not want to identify which one as yet.

Wascher said his company also intended to expand its product portfolio. For more information on the technical aspects of SMA, read our article here. —[email protected]

About the Author(s)

You May Also Like