We're number one? Not when it comes to our readiness in taking advantage of the continued globalization of trade. In fact, the United States ranks next to last—ahead of Japan but after Italy—according to a study conducted by UHY, a global network of independent audit, accounting, tax, and consulting firms.

January 15, 2014

We're number one? Not when it comes to our readiness in taking advantage of the continued globalization of trade. In fact, the United States ranks next to last—ahead of Japan but after Italy—according to a study conducted by UHY, a global network of independent audit, accounting, tax, and consulting firms.

The United States is positioned well behind many European countries and China based on a number of factors; the only category where the United State fares well is in ease of doing business, where it ranks fourth among 27 developed and emerging economies. Some will shrug this off. As unemployment remains stubbornly high and wages are stuck in neutral, they ask, do we really need to focus on our standing in the globalization sweepstakes? UHY analysts think we should. As the pace of globalization continues, write the authors, rising incomes and increased consumption in emerging economies will be key drivers of economic growth in the years ahead.

UHY took into account the following factors when ranking the 27 countries:

favorable tax arrangements with potential trading partners;

export performance;

role of trade in the domestic economy;

taxation policies vis-à-vis repatriated profits;

ranking in World Bank's ease of doing business metrics;

labor costs.

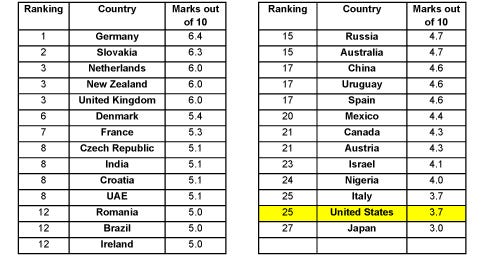

Based on these parameters, the United States scored 3.7 out of 10, well behind China and several EU member states. Germany, for example, led the ranking with a score of 6.4. Slovakia, the Netherlands, United Kingdom, and Denmark were all in the top 10. Among the BRIC countries, India ranked highest (in a three-way tie with the Czech Republic and Croatia for eighth place). One of the major reasons for the poor US performance, according to analysts, is the tax burden on repatriated profits.

|

Twenty-seven countries ranked according to their ability to take advantage of the future globalization of trade. Table courtesy UHY. |

"One key factor hampering the U.S. from fully harnessing globalisation is that it levies the highest tax charge on repatriated profits of all countries, potentially acting as a significant barrier to domestic companies looking to expand overseas," says Richard David, Chief Operating Officer for UHY Advisors Inc., a US member firm of UHY. While the US is somewhat cushioned by the sheer size of its own domestic economy, adds David, "it could achieve more by doing more to encourage and support American companies in exporting and expanding overseas." Notably, the imposition of taxes on profits repatriated from overseas operations is a disincentive for businesses contemplating expanding their operations. The United States is one of the last few countries still operating such a system, notes the report.

I asked SPI's Michael Taylor, Senior Director, International Affairs and Trade, for his thoughts on the study and how it applies to the plastics industry. He agreed that the comparatively high tax burden on repatriated profits, not to mention the 40% corporate tax rate, weigh heavily on US companies' global competitiveness. However, "the six factors examined by the organization do not take into account all of the relevant factors for evaluating a country's readiness to take advantage of globalization, such as innovativeness, labor productivity, or brand power," Taylor told PlasticsToday. "It seems to overemphasize somewhat the importance of the tax code."

In any event, the plastics industry is comparatively well positioned to ride the wave of globalization, says Taylor. "When our companies expand their operations globally, they are very competitive and do extremely well. From 1980 to 2012, when comparing the U.S. plastics industry to all other U.S. manufacturing, it has grown faster in employment, dollar value of shipments, and productivity," he says.

These days, however, the plastics industry has plenty on its plate on the domestic front, and is not as concerned with global expansion. "With the positive impacts of shale gas, the growing global demand for advanced and innovative plastic products, long-term drivers encouraging reshoring of manufacturing, and significant free trade agreements on the horizon, the future global competitive position of the U.S. plastics industry looks bright, in spite of the abovementioned negatives of the current tax code," says Taylor.

About the Author(s)

You May Also Like