Sponsored By

News

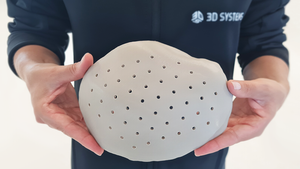

coral reefs

Biopolymers

How Plastic Straws Are Helping to Restore Coral ReefsHow Plastic Straws Are Helping to Restore Coral Reefs

Phade biodegradable drinking straws are being used to build “Coral Forts” that protect newly planted coral from predators.

Sign up for the PlasticsToday NewsFeed newsletter.