Sponsored By

News

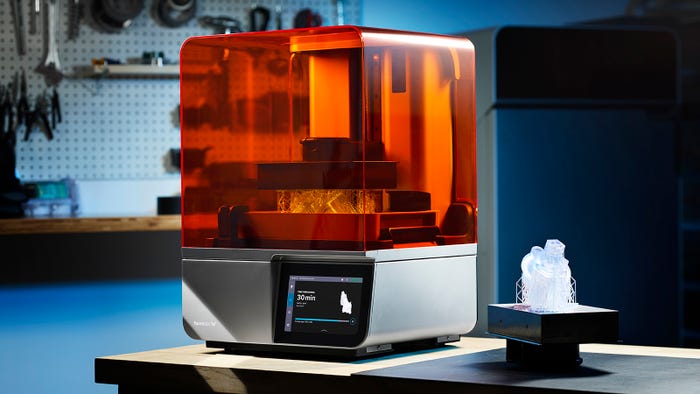

colorful plastic resin

Resin Pricing

Resin Price Report: Soft Prices About to Get SofterResin Price Report: Soft Prices About to Get Softer

A polypropylene price decrease this month should break into double digits, says the PlasticsExchange.

byStaff

Sign up for the PlasticsToday NewsFeed newsletter.