The annual EvaluateMedTech World Preview report always contains an abundance of insights on where the medical technology industry is today and how it will look in the near future. The fourth edition, which was published earlier this week, is no exception.

October 8, 2015

The annual EvaluateMedTech World Preview report always contains an abundance of insights on where the medical technology industry is today and how it will look in the near future. The fourth edition, which was published earlier this week, is no exception.

Time was when the medical device industry was widely thought of as recession proof. The sector was known for solid, steady growth without the ups and downs of the automotive sector, for example. That view has changed somewhat—the Great Recession left no sector untouched—but the medtech industry largely has returned to its comfort zone, where it will remain into 2020. That seems to be borne out by the forecasts compiled in the report by Evaluate Ltd., a consultancy headquartered in London that specializes in life science business analytics.

Evaluate pegs 2014 sales for the global medtech industry at $375.2 billion; based on a forecast of 4.1% annual growth, sales in the medical sector are expected to reach $477.5 billion by 2020.

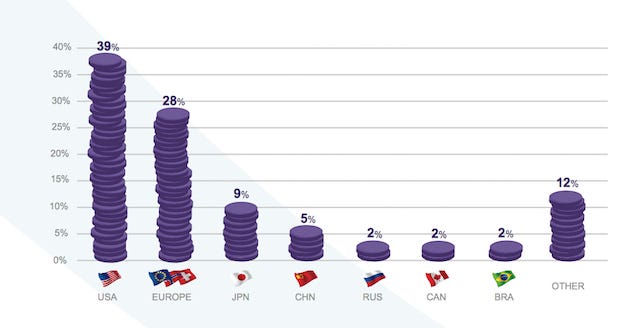

The United States is the largest medtech market in the world, accounting for almost 40% of sales, followed by Europe at 28% and Japan and China at 9% and 5%, according to statistics compiled by pan-European trade association Eucomed. This ranking is not likely to change significantly, with the exception of China, which is poised to overtake Japan and, according to some analysts, may be the second largest medtech market in the world by 2020. The Boston Consulting Group projected a 14% annual compound growth rate for China's healthcare sector in a report it published three years ago, which would have it overtaking Japan; of course, there have been some shifts in the economy, unanticipated at the time, that may affect these numbers. Still, China has become a major world player in the medtech sector in a remarkably short period of time.

|

Medtech markets by geography. Graphic courtesy Eucomed. |

That's the current context. Now, here are some of the key projections from Evaluate MedTech World Preview 2015, Outlook to 2020. The full 36-page report can be downloaded free of charge (registration required) from Evaluate's website.

Johnson & Johnson is still the largest medical device company in the world, but not for long. By 2020, Medtronic, which swallowed up Covidien in the largest medtech deal in the history of the industry earlier this year, will be top of the hill. In 2014, J&J reported $27.5 billion in sales, a drop of 3.4% from 2013, whereas number two Medtronic had $20.3 billion, a jump of 19.1% over 2013. By 2020, Evaluate predicts that Medtronic will have $34.9 billion in sales compared with J&J's $29.7 billion. The top 10 sees some reshuffling but is largely unchanged, with Siemens, Roche, Abbott Laboratories, Stryker, Phillips and General Electric maintaining their presence. Covidien, of course, is no longer in the 2020 ranking, while Boston Scientific moves up a notch to the 10th position (it was 11th in 2014), and Danaher drops from number 9 to 11 in 2020.

The worldwide prescription drug market will outpace the medtech market through 2020. The pharmaceuticals sector is forecast to grow 4.9% per year compared with medical devices, which is expected to record 4.1% growth. The report notes that both sectors are forecast to contract in dollar terms as a result of weakness in the euro.

Global medtech R&D expenditures are forecast to grow 3.5% annually, reaching $29.5 billion in 2020. It is worth noting that the rate of growth in R&D spending is below the rate of growth forecast for sales, resulting in a drop in the R&D investment rate from 6.4% in 2014 to 6.2% in 2020. Although Evaluate does not speculate in terms of causality, opponents of the 2.3% medical device excise tax, which is part of the Affordable Care Act, have warned that companies will offset this expense by cutting back on R&D. The tax went into effect on January 1, 2013. When you see the precipitous drop in the growth rate of R&D spending starting in 2012—from 9.6% in 2011 to 2.5% in 2012 and declining to 0.6% in 2014—it does give one pause.

In vitro diagnostics will remain the top medical device area in 2020 with sales of $67.3 billion followed by cardiology ($54.2 billion), orthopedics ($42 billion) and imaging ($40.9 billion).

About the Author(s)

You May Also Like