US Plastics Industry Slowdown Has Hit Bottom, Says Pineda

The chief economist of the Plastics Industry Association projects a return to growth in 2024.

September 8, 2023

By the time 2023 comes to a close, real plastics shipments probably will have decreased by 3% compared with 2022 and employment will have fallen by 2.2%, according to Perc Pineda, PhD, chief economist at the Plastics Industry Association (PLASTICS). To put those negative numbers in perspective, however, it’s worth noting that the value of shipments — shorthand for sales, according to Pineda — increased 2.6% in 2022 and 1.8% in 2021. More importantly, 2024 promises to put the plastics industry back in the black, with employment forecast to rise 1.2% and real plastic shipments growing 1%. Pineda shared his observations and projections during an executive briefing yesterday in conjunction with the release of PLASTICS’ 2023 Size and Impact Report.

Plastics industry routinely outperforms overall manufacturing

Despite the inevitable down cycles, the underlying trend for the plastics industry continues to be growth oriented. In fact, it historically outpaces the manufacturing sector as a whole, noted Pineda. For example, plastics shipments rose by 1% between 1997 and 2022, whereas total manufacturing shipments fell by 0.1% during the same time period. Added value — the contribution of the plastics industry to the overall economy — grew 4.4% in the last five years while total manufacturing eked out a modest 1.1% gain. And between 2012 and 2022, employment in the plastics industry increased 1.3% each year, compared with 0.7% for manufacturing, said Pineda.

|

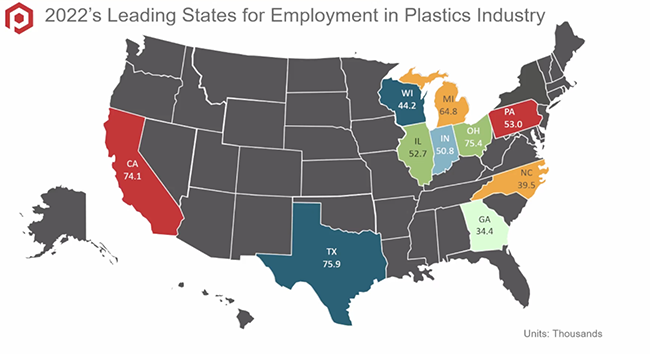

Texas had the highest number of plastics industry employees in 2022, followed by Ohio and California. Indiana has the highest per capita rate of plastics employment — 16 out of every 1000 non-farm jobs in Indiana are in the plastics industry. |

In presenting his outlook for the industry, Pineda referenced the headwinds as well as tailwinds affecting the plastics industry. Contributing to the headwinds, which have been buffeting companies since the fourth quarter of 2022, is the high cost of capital. Pineda cited some publicly traded companies in the plastics sector that have seen double-digit increases in interest expenses. Weaker household spending and an abundance of inventory in the retail sector since December 2022 have affected consumption of plastic products.

Positive impact of reshoring

At the same time, there are unmistakable tailwinds in this slightly baffling economy: Reshoring will have a positive impact in the medium term, said Pineda; personal consumption for non-durable goods appears to be relatively stable; and automotive production is robust and will continue to be in 2024.

Pineda acknowledged that some may be discouraged by the negative numbers in the current business cycle, but all told, “there is so much value in the plastics industry . . . that these numbers should be considered transitory. There is a silver lining,” said Pineda, adding that he thinks the slowdown of economic activity has already hit bottom and is poised to rebound.

The 2023 Size and Impact Report is now available to download from the PLASTICS website. It offers an overview of the US plastics industry and includes various economic data summarizing manufacturing areas including equipment, employment, and shipments. The report is free to PLASTICS members; the nonmember price is $995.

About the Author(s)

You May Also Like