The Hedging Corner: Plastics and oil, inextricably linked

The transparency and, therefore, fairness of resins prices in physical (i.e. cash) markets is a top concern among processors. Most other commodity markets are far more transparent than resins. Finding current prices for energy, metals, grains, etc. is primarily a matter of checking the futures markets in those commodities.

May 3, 2011

The transparency and, therefore, fairness of resins prices in physical (i.e. cash) markets is a top concern among processors. Most other commodity markets are far more transparent than resins. Finding current prices for energy, metals, grains, etc. is primarily a matter of checking the futures markets in those commodities.

While recently opened resins futures contracts in Polypropylene, HDPE, and LLDPE are certainly transparent - and somewhat easy to execute via CME ClearPort or open outcry on the NYMEX - are they fair indicators of prices in the over-the-counter markets like other commodity futures contracts? If so, are they the best and only means for hedging resins prices, or are there more liquid and option-able alternatives that enable hedgers to hedge more wisely and cost-effectively - and, by the way, limit their vulnerability to being second-guessed by internal or external naysayers? Based on an analysis of daily prices, it appears so.

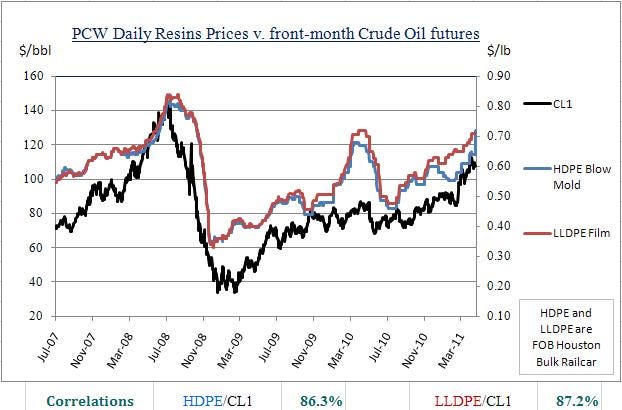

As noted in the Purvin & Gertz and CMAI Upstream/Downstream process chart, resins and crude oil are inextricably linked. Given that, and setting aside for now the role of natural gas prices, one would expect a correlation between resins and crude oil prices. What are the correlations? Is the frequency of the data important?

Resin prices compared to crude prices

PetroChemWire has tracked daily resins prices since 2007, and a chart comparing their daily prices in HDPE and LLDPE with daily settlements in the front-month crude oil futures contract shows a high level of correlation. Surprisingly, given the historical nature of resins prices (stable for days and weeks at a time) and the volatility of crude oil prices, the correlations are near 90%. Such a high level of correlation might be expected on a weekly to monthly basis, but daily?

These high correlations indicate crude oil futures, and accompanying options and exchange traded funds (ETFs), may be effectively used to control resins costs as an alternative to, or in conjunction with, resins futures contracts. This makes hedging resins prices much easier - and safer - than resins processors might think. Need more evidence of the correlation between resins and crude oil prices? Visit the Hedging Corner next week.

The means to hedge resins prices are getting better, but waiting until they are highly liquid and option-able doesn't appear to be necessary. A very effective means has been "out there" for a while.

About the Author(s)

You May Also Like