April 13, 2016

Finding ways to be competitive in a global market is every custom molder’s challenge. New technologies, such as 3D printing (aka additive manufacturing), can provide value and help a molder be more competitive, but they also can be expensive to implement. It helps to understand just how the technology fits into your business model and what value it adds for your customers and your company.

|

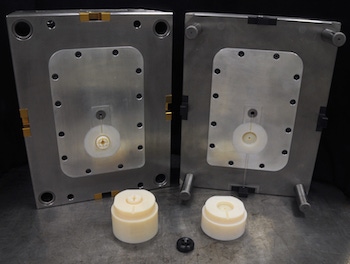

3D-printed tooling produced by Polymer Conversions for a "community project" |

Meeting a medical device customer’s need to reduce R&D costs was the impetus for Polymer Conversions, a custom injection molder and moldmaker in Buffalo, NY, to explore the value of 3D printing early last year. “Our company has always been driven by making sure we’re utilizing the right tools for the application so we can perform better,” said Ben Harp, Chief Operating Officer for Polymer Conversions. “We’ve always explored technology to make the injection molding process an easier experience for the customer with the goal of fewer rejects, more cost effective, on-time delivery and pricing certainty.”

Polymer Conversions, which operates 26 presses from 30 to 390 tons, understands how critical quality, lead times and R&D costs are in product development, Harp explained to PlasticsToday. Listening to its customers inspired the company to look at technologies to help meet these requirements.

“One of our long-time customers talked to us about how they love everything we do for them but would like to see us help them move faster in terms of medical device development, and reduce the cost of developmental tooling,” Harp said. “They emphasized that this was a high priority for them given the nature of the medical device industry. We used that as the driver to look at technologies and our systems and try to support them.”

Polymer Conversions identified 3D-printed tooling as a possible solution, because it answered many of the drivers that are important to its customers. “We have many medical and healthcare customers that want to do iterations of a new product, but R&D budgets get tighter and tighter, due in part to increased competition in a global market and government regulations like the medical device tax in the Affordable Care Act. That had a ripple effect on medical device companies and their willingness to invest more in R&D while everyone waited for the results of the ACA to roll out." [Editor’s note: In December 2015, Congress suspended the 2.3% medical device tax for two years, which means it can still be brought back.]

Becoming more dynamic with the product development process meant that, if the company is successful, it offers “a good opportunity to separate ourselves from the competition in the marketplace,” Harp noted.

Polymer Conversions has always made developmental tooling—sometimes called “soft” tooling—out of P20 or aluminum that would be like a traditional tool. However, Harp pointed out that it could take as long as eight to 15 weeks in design and construction using even the softer steels or aluminum. Additionally, the cost could be anywhere from $10,000 to $25,000—a considerable investment for a healthcare company just to determine if the device works and if it will be accepted in the market.

The process also meant that part design and mold changes were required, and that a new product would undergo several iterations before the customer decided upon a final design, adding time and cost. When the developmental stage was completed, the process had taken a lot of time for engineering changes, tooling changes, testing, sampling and re-sampling. “All of that takes time and money, and limits companies’ willingness to take on too many projects,” said Harp.

The company started the process last year by laying out the business model early on and creating the team that would be in charge of the program. “We talked about what we need to do to get into R&D, what tools we need, and laid out the design for the mold frame tool to hold the inserts, to get as much tool flexibility as possible.” The five members of the 3D-printing team include a toolmaker, process engineer, mold designer, quality engineer, and university engineering intern.

3D printed tooling using the FDM process from Stratasys began to look like a viable method to meet the customers’ requirements for reduced time and costs. But rather than jump into a technology the company had no expertise in, Polymer Conversions called on a local manufacturing partner, Staub Machine Co., which specializes in traditional subtractive machining (Staub Machining) and 3D printing through its division Staub Additive.

“We’ve worked with Staub before on projects, so we began working with them jointly on 3D printing of core and cavity inserts. Staub Additive’s equipment includes a Fortus 400mc FDM machine from Stratasys with a 16 x 14 x 16 in. build box; a Polyjet Connex3 machine with a 19.3 x 15.4 x 7.9 in. build box; and a desktop SLA unit, the Form1, from Formlabs.

“Through 3D tooling, we’ve been building our experience in that area, so there are many types of parts that allow us to showcase this technology to our customers,” said Harp. “This capability gives us the ability to give our customers their dream scenario, because we can 3D print the core and cavity inserts within hours, and within 48 to 72 hours, we can be in the press molding parts from that tool. The lead time to put functional parts in their hands in the actual materials—where they are comfortable with them to do functional testing—has gone from 10 to 15 weeks to 72 hours. That’s a dramatic compression for the development time line.”

Polymer Conversions offers cavity sets that fit into its own specialty built universal mold frames. “Speed and dollars are what is critical to our customers,” stated Harp. “The process yields parts with near-spec tolerances, which is a good start in the product development cycle, and gets customers far enough down the path to know whether it is a legitimate program to continue or [if they should] move on to another project.”

Another benefit Polymer Conversions’ customers have realized is that the lower cost of 3D-printed cores and cavities allows their R&D funds to go further, so that they can try multiple new products, Harp explained. “It also puts the OEM in the position where engineers can look at a product’s design in several ways and try various design styles through numerous iterations,” he added.

The next step for Polymer Conversions will be to bring 3D-printing capabilities in-house. Collaborating with Staub Additive has given both companies greater expertise in printing core and cavity inserts and understanding what is possible for molding parts. Harp believes, ultimately, that 3D-printing capabilities will be part of almost every molding and moldmaking facility’s offerings. “In five to 10 years, tool construction will be made up of additive manufacturing as well as traditional subtractive methods,” Harp concluded.

About the Author(s)

You May Also Like