Wohlers’ new 3D printing report shows upstarts successfully challenging ‘establishment’

The additive manufacturing (AM) industry grew by 17.4% in 2016, down from 25.9% the year before, but it would have grown by 24.9% if the two largest manufacturers of AM systems, which reported year-on-year declines, had been excluded from the analysis.

April 5, 2017

Wohlers Associates Inc. (Fort Collins, CO), a leading consulting firm and top authority on additive manufacturing and 3D printing worldwide announced the publication of Wohlers Report 2017. This edition marks the 22nd consecutive year of the highly regarded industry overview.

|

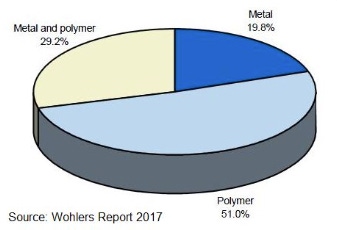

More than half of additive manufacturing services are running polymer-only systems. |

According to the report, 97 manufacturers produced and sold additive manufacturing (AM) systems in 2016, up from 62 companies in 2015 and 49 in 2014. These manufacturers are providing interesting products and unprecedented competition in the AM industry. This wave of development and commercialization is putting pressure on the established producers of AM systems, said Terry Wohlers, founder and CEO of Wohlers Associates.

The AM industry grew by 17.4% in 2016, down from 25.9% the year before, according to the report. Much of the downturn came from declines by the two largest system manufacturers in the business. Together, they represent $1.31 billion (21.7%) of the $6 billion AM industry, according to Wohlers Report 2017. If these two companies were excluded from the analysis, the industry would have grown by 24.9%.

Find out what’s new and what’s coming in 3D printing at the 3D Printing Summit at this year’s PLASTEC East event in New York City in June. Go to the PLASTEC East website to learn more about the event and to register to attend. |

Nearly half of all service providers surveyed are running AM systems that produce metal parts, with 19.8% providing metal AM services and 29.2% providing both metal and polymer. Just over one-half provide polymer-only AM services.

Each year, the Wohlers Report provides analysis based on many years of data. For the new report, input was collected from 100 service providers, 61 industrial system manufacturers and 19 producers of third-party materials and low-cost desktop 3D printers. Separately, 76 experts and organizations in 31 countries contributed information and insight to the new publication.

Declines at two largest AM companies

In looking at the latest 2016 annual reports released from the two largest AM manufacturers, PlasticsToday found that 3D Systems Corp. (Rock Hill, SC) saw its 2016 revenue decrease 5% to $633 million compared to $666.2 million in 2015, which included approximately $20 million from consumer products that the company discontinued at the end of 2015. The company reported a GAAP loss of $0.35 per share for 2016 compared to a loss of $5.85 per share in 2015.

“Demand from industrial customers combined with growth in software and healthcare services were not enough to offset the impact of weaker sales of professional printers and on-demand services, resulting in a 10% decrease in revenue in the fourth quarter of 2016 compared to the fourth quarter of 2015,” said 3D Systems.

Vyomesh Joshi, CEO of 3D Systems, commented, “Continued demand for our production printers and materials reaffirms our belief that our industry is at an inflection point in the transition from prototyping to production.”

Fourth quarter and full year 2016 financial results released by Stratasys Ltd. (Eden Prairie, MN) on March 9, 2017, revealed that while revenue for Q4 of 2016 was up—$175.3 million compared with $173.4 million for the same period in 2015—revenue for fiscal 2016 was down slightly to $672.5 million compared with $696 million for fiscal 2015.

“We are pleased with our fourth quarter results, and the progress we are making to improve and deepen customer engagement,” said Ilan Levin, CEO of Stratasys. “Our increased revenue, combined with the ongoing activities to better align our cost structure, contributed to a significant improvement in operating profit and cash generation during the quarter. Additionally, we are encouraged by the growth in our recurring revenue during the period, demonstrating strong utilization of our installed base of systems, ” said Levin.

About the Author(s)

You May Also Like