Suppliers urge automakers to provide timelier short- and long-term forecasts and production schedules to maintain good working relationships.

May 22, 2023

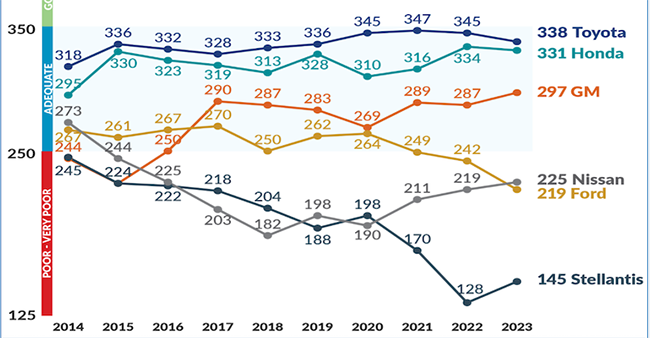

Results of the 23rd annual North American Automotive OEM-Supplier Working Relations Index (WRI) that evaluates the relations between US automakers and their suppliers have been released by business consulting firm Plante Moran. The results saw Toyota and Honda in a close one-two, with a slight gap for third-place GM. Nissan overtook Ford to place a distant fourth, while Stellantis brought up the rear in sixth.

|

Toyota retains the top spot in the annual North American Automotive OEM-Supplier Working Relations Index. |

The Working Relations Index measures the total commercial relationship, which is a function of perceived trust, timely communication, mutual profit opportunity, assistance, and reduced friction in dealings with automakers.

Need for timely, accurate forecasts a key takeaway

One of the key takeaways from the study related to the plastics processing sector is the need for OEMs to communicate accurate short- and long-term forecasts and production schedules to suppliers in a more-timely manner. This is especially true given market conditions, such as supply chain disruptions and new technologies that change product plans and manufacturing strategies.

Further, cost-recovery mechanisms should not be judged in isolation, according to the study. Inflation-driven cost increases and adjustments need to be addressed in a timely manner that is consistent, tested, and institutionalized and supported by OEM and supplier cost-reduction efforts.

Suppliers seek partnership approach

In addition, OEM product plans and technology requirements need to be articulated and communicated to suppliers, such that they know where they and their products fit into long-term strategies. OEM decision-making should also be located nearby and reinforce where supplier sourcing and manufacturing occurs.

The study highlights rising tension over increased risk related to short-term cost-recovery issues, production scheduling, and supply chain disruptions as the industry transitions to electric vehicles (EVs). This is compounded by suppliers’ long-term strategic issues related to adequate insight into automakers’ EV strategy and timing so they can effectively plan for the transition in terms of capital, acquisitions, and staffing investment.

EV challenges on the line

"The industry continues to face unprecedented challenges in the shift to EVs that, unless effectively addressed, will only get worse," said Dave Andrea, Principal in Plante Moran's Strategy and Automotive & Mobility Consulting Practice, which conducts the annual study. “During Covid, a ‘war room’ approach was adopted to quickly resolve critical issues. That approach is what auto manufacturers need to maintain during the transition to EV technologies. The industry needs that level of collaboration, even without the pressure of a crisis,” said Andrea.

About the Author(s)

You May Also Like