Challenges and Opportunities in Sustainable Polyurethane Production

Major polyurethane (PU) suppliers and multiple startups are developing bio-based or recycled alternatives for PU feedstock, a trend that will strengthen in the years ahead.

August 19, 2021

Vikash Kumar

There are more than 1,000 commercially available polymers. However, only a handful of materials, such as polyolefins, PVC, polystyrenes, and polyesters, command a major market share by volume. Among those materials, polyurethane (PU) has been a target of sustainability research. There are many drivers behind the research into sustainable PU and its subsequent commercialization. Based on ChemBizR’s deep experience in the polymer industry, end user markets, and sustainable products, the critical factors can be identified, as follows.

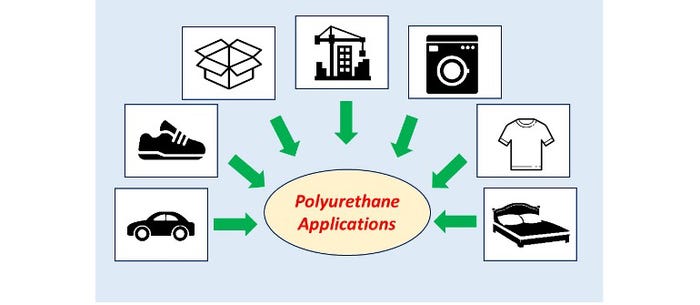

Massive presence in end markets

Through its various forms — rigid; flexible; coatings, adhesives, sealants, and elastomers (CASE); and others — PU is deeply entrenched in end markets, and it is well known that interest in sustainability gains traction the closer a material is to end consumer markets. Environmental awareness among consumers affects their consumption patterns, which has accelerated the pace of manufacturers’ migration toward raw materials and processes that are perceived to be more sustainable and environmentally friendly than alternatives.

Robust growth in PUs

PU accounts for approximately a 6 to 8% market share in the $570 billion US polymers market, according to data from ChemBizR. Although PU volumes are relatively low compared with other polymers, its approximate 7% annual growth rate, as forecast by ChemBizR, makes PU an attractive investment candidate for a sustainable option that potentially could be adopted by the entire industry.

Multiple routes to sustainability

PU’s basic precursors, polyols, can be produced either by recycling or from renewable sources. Recycling polyurethane to obtain polyols and using them with virgin polyols to make PU is being commercialized. Polyols derived from renewable resources such as plants are also commercially employed in making PU foams and coatings used in numerous products. Thus, the availability of both options leads to a two-prong strategy for attaining sustainability. In the case of isocyanates, progress has been slow but is expected to gather pace as the development of renewable aniline continues to be investigated.

|

Sustainable PU has been commercially available for a decade. However, the pace of commercialization has increased tremendously in the past couple of years. The current status of sustainability is analyzed here at the supplier and customer levels.

PU suppliers

Global PU suppliers increasingly are adopting the use of either bio-based or recycled raw materials. For example, Covestro is using polyester polyols based on succinic acid feedstock for use in thermoplastic polyurethane (TPU) and water-based PU dispersions (synthetic leather applications). BASF is working toward circularity by recycling mattresses to recover raw materials at a quality comparable to virgin resin. Its process breaks down flexible polyurethane to capture polyols. And Dow’s Renuva mattress recycling program converts discarded mattress foam back into raw polyols via chemical recycling.

PU customers

Building and construction: The major consumption of polyurethanes in the construction industry is in rigid foam insulation. However, the demand for bio-based polyurethanes and other sustainable PU products primarily is driven by coatings and adhesives applications. PPG offers bio-based architectural coatings based on a binder developed by DSM. These resins are derived from bio-based polyurethanes and acrylates.

Automotive and mobility: Ford claims to have been using soy-based polyols in PU foam for seat cushions, seatbacks, and head rests. Volvo uses limited bio-based materials in its cars. It had experimented with using soy-based foam in car interiors, such as seats; however, its primary focus is on the use of recycled materials

Footwear and sports: Nike reportedly uses bio-TPU developed by Merquinsa, a subsidiary of Lubrizol Co., for soles in limited shoes. The bio-TPU contains castor-derived polyols that are blended with conventional petroleum-based polymers. Last year, Adidas launched its 100%-recyclable performance running shoe. Each component is made from 100% recyclable TPU.

Appliances: Adoption of bio-based materials in appliances has been quite slow, primarily because of the precise performance specifications. Areclik, a Turkish multinational household appliances manufacturer, came up with a “bio refrigerator” in 2019 that used bio-PU-based insulating materials.

Conclusion

Multiple factors are driving demand for sustainable PU, from customers to materials suppliers, converters, and OEMs. However, uptake has been hampered by performance requirements, relatively difficult processability, a limited supply of raw materials, and high cost. To address these challenges, major polyurethane suppliers and multiple startups are developing bio-based or recycled alternatives for PU feedstock. This trend is expected to strengthen further in the future across different application segments as the sustainability movement gathers steam.

About the author

Vikash Kumar is Program Lead, Polymers & Materials, at ChemBizR, a boutique business research and consulting partner of global chemicals companies. It helps them address critical business challenges and strategic growth initiatives and to transform their enterprise for sustainable growth in a highly competitive and rapidly evolving environment. Contact the author and the company at [email protected].

You May Also Like