Consolidation gains traction in automotive interiors segment

Consolidation in the automotive interiors industry will lead to the emergence of a few major suppliers that will have more bargaining power with OEMs.

February 21, 2017

Consolidation in the automotive interiors business seems to be an ongoing theme, as suppliers narrow their focus and become more specialized, meaning that mergers and acquisitions will remain a core strategy for value creation in this segment. That’s according to an editorial from IHS Automotive SupplierInsight. Keeping track of all this activity in this vehicle segment is a bit like watching two tennis matches at the same time—it’s tough to tell whose ball is in which court.

IHS Automotive SupplierInsight noted that companies such as Magna International “realized it can make better margins in transmissions than interior components, so alongside acquiring Getrag to boost its position in the transmissions market, it also sold its non-seat interiors business to Spanish supplier Group Antolin. This strategy of acquiring “specific business units” rather than entire companies is creating larger business entities with more clout when it comes to Tier 1s dealing with the big OEMs, said IHS Automotive SupplierInsight.

The automotive supply chain has a new rendezvous. UBM America’s newest design and manufacturing trade show and conference debuts in Cleveland, OH, on March 29 and 30, 2017. On one show floor, Advanced Design & Manufacturing (ADM) Cleveland showcases five zones—packaging, automation and robotics, design and manufacturing, plastics and medical manufacturing. Hundreds of suppliers and numerous conference sessions offer sourcing and educational opportunities targeted to the automotive and other key industry sectors. Go to the PLASTEC Cleveland website to learn more and to register to attend. |

The editorial pointed out that Magna’s deal with Grupo Antolin as well as Johnson Controls’ deal with Yanfeng “were in line with this trend. Visteon has progressively sold its interior business to Reydel, which is now owned by private equity company Cerberus."

Magna is now focusing more on its seating business, announcing on January 30 that Magna Seating has moved into a new, state-of-the-art headquarters in Novi, MI. The new facility includes three floors and 180,000 square feet of space. Approximately 450 employees will work at the building with room for future growth.

Magna also announced in December that it has won multiple new seating programs from the BMW Group, which will be supplied from a new, state-of-the-art seat manufacturing facility in Spartanburg County, South Carolina. Construction recently started on the 230,000-square-foot facility; it is expected to be operational in June 2017, and could employ up to 480 people by 2020. The facility will feature dedicated assembly and sequencing lines to supply seats for various BMW models at the BMW Group’s nearby assembly plant, said the company’s news release.

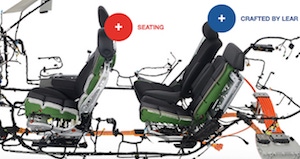

Now that Grupo Antolin has acquired Magna’s non-seating business to strengthen its market share in cockpits and consoles, overheads and soft trim, and doors and hard trim, U.S. seating supplier Lear “entered into a definitive agreement to acquire Group Antolin’s seating business for $308 million, said the editorial. “The deal strengthens [Lear’s] ties to European automakers, with the acquired unit’s annual sales of approximately $322 million concentrated in five European countries, said IHS, noting that the transaction is expected to close in the first half of 2017, subject to regulatory approvals in Europe.

For Lear, which IHS said “is one of the biggest seating suppliers globally, the acquisition makes perfect sense,” as its revenue has grown consistently in the seating segment over the past five years, from $11 billion in 2012 to more than $14 billion in 2016, at a compound annual growth rate of more than 5%. Earnings grew from $66 million to $1.1 billion over the same period and its margins have also improved from 4.8% in 2013 to 8.2% in 2016. Lear has 22% market share in the global seating market, which it sees growing to nearly 27% in 2021. The company told IHS Automotive SupplierInsight that this growth covers all regions, including China.

About the Author(s)

You May Also Like