2021 Report on Size and Impact of Plastics Industry Predicts Continued Growth

The annual report from the Plastics Industry Association forecasts a 2.2% increase in plastics manufacturing shipments this year.

September 22, 2021

The publication this week of the 2021 Size & Impact Report by the Plastics Industry Association (PLASTICS) was heralded yesterday in a webinar led by Perc Pineda, PhD, Chief Economist of the association. Here are some key takeaways from his presentation. The report itself is available for download free of charge to PLASTICS members; $995 for nonmembers.

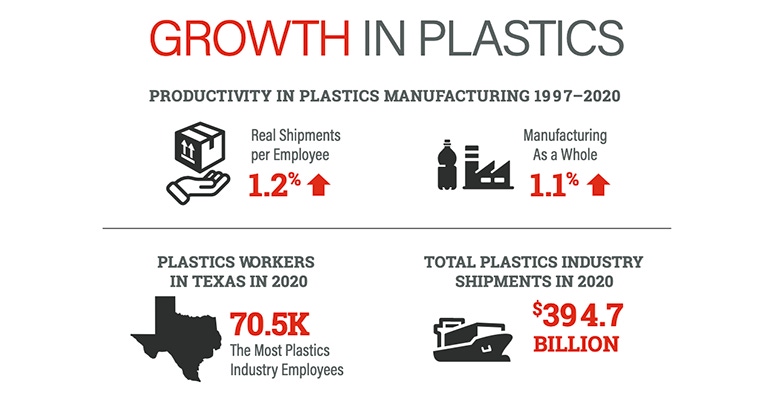

Plastics was the eighth largest industry in the United Sates in 2019 (the most recent year for which data is available). It accounts for almost one million jobs; that number grows to approximately 1.5 million jobs if suppliers to the industry are factored in. Productivity in the plastics industry routinely surpasses manufacturing as a whole, noted Pineda.

Plastics industry shipments last year totaled $394.7 billion, not including upstream contributions by suppliers. If you include suppliers, the total shipments reach about $541.5 billion. If you also include downstream parameters, that dollar figure is really a minimal estimate of the impact of the plastics industry on the US economy, added Pineda.

The COVID-19 recession resulted in an estimated 0.9% decrease in the real value of shipments, according to Pineda, and about a 2.4% decrease in nominal terms.

PLASTICS estimates the material cost component of materials at 51 cents per dollar in shipments in 2020. That is slightly lower than in 2019, when it was 53 cents.

The number of plastics manufacturing establishments in the United States continues to decline year on year as a result of M&A activity. In addition to operational efficiency and profitability, this trend is also driven by internationalization, as companies try to gain entry into foreign markets, said Pineda. Lingering supply chain issues also are playing a role, as companies seek to enhance operational capabilities.

In terms of employment, Texas and Ohio garnered the top spots, with each employing approximately 70,500 people in the plastics sector, closely followed by California at 69,800. Pineda noted that each job in the plastics industry was responsible for the creation of 0.64 upstream jobs. In the resin sector, Texas had the most jobs, followed by Louisiana. Ohio took the lead in plastic product manufacturing at 7.9%, followed by California at 7.2%. Ohio also has the largest number of employees in plastics machinery — 14.9% — and Michigan leads in mold production at 19.3%.

|

Graphic courtesy Plastics Industry Association. |

What’s next? Manufacturing is the main customer of the plastics industry, so it makes sense to use the outlook for manufacturing as a whole as a basis for plastics, said Pineda. There are promising signs in consumption of durable and nondurable goods, he noted. Packaging for take-out food will remain stable: Pineda pointed to a report showing that plastic content in soft drink and snack food packaging accounted for 12.1 cents per dollar of the product. Electric vehicles also represent a tremendous opportunity, as OEMs seek further weight reductions to increase range per charge, added Pineda. All in all, he expects to see a 2.2% increase in plastics manufacturing shipments this year, not including captive plastics, following the 0.9% decrease in 2020.

About the Author(s)

You May Also Like