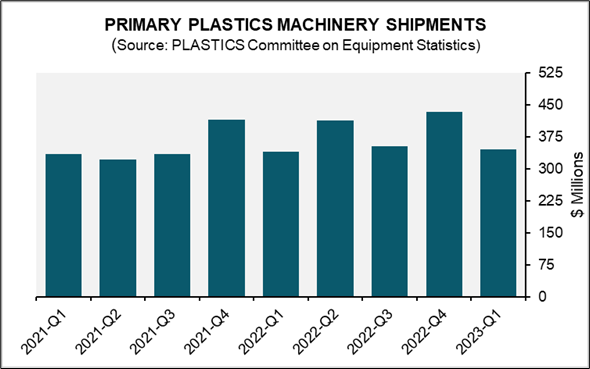

US Plastics Processing Equipment Shipments Post Slight Year-Over-Year Increase

Shipments of injection molding and extrusion equipment increased by 1.6% compared with Q1 2022.

May 25, 2023

Shipments of injection molding and extrusion equipment in Q1 2023 contracted just over 20% compared with the previous quarter, according to the Plastics Industry Association's Committee on Equipment Statistics (CES). The $345.8 million preliminary estimate for the quarter, however, represents a 1.6% increase in value compared with the same period last year.

|

“Despite a weaker economic outlook, plastics machinery shipments managed to show year-on-year growth,” said Perc Pineda, PhD, Chief Economist at the Plastics Industry Association, in a prepared statement. “First-quarter shipments were slightly lower than the previous quarter, but this is typically expected as the first quarter tends to have lower shipment volumes. The current first-quarter shipments are comparable to previous quarters during economic expansions,” said Pineda.

Single-screw extruder shipments drop 28%

Single-screw extruders saw the largest decrease in value at 28.4%, followed by a 19.9% decrease in injection molding shipments from the previous quarter, according to the CES. Shipments of twin-screw extruders declined by 14.7% during the same period. When comparing shipments to a year earlier, however, single-screw and twin-screw extruders increased by 11.4% and 94.9% respectively. Injection molding shipments, on the other hand, experienced a 2.7% decline.

The CES also conducts a quarterly survey among plastics machinery suppliers. Fewer respondents said they expected market conditions to remain unchanged or to improve in the next quarter, 35.0% versus 33.0% in the previous quarter. Similarly, the percentage of respondents anticipating unchanged or improved conditions in the next 12 months decreased from 45.0% to 38.0%.

Exports decline, imports increase

US plastics machinery exports experienced a 2.9% decrease in Q1 2023, amounting to $229.3 million. Mexico and Canada remained the top export markets for US plastics machinery, with combined exports to these countries totaling $115.6 million, accounting for approximately half (50.4%) of the total US plastics machinery exports, according to the CES. Imports increased by 6.7% to $535.7 million in the first quarter. As a result, the US plastics machinery trade deficit reached $306.4 million.

The implementation of contractionary monetary policy in March 2022 is beginning to impact the financial market and will have broader implications for the manufacturing sector, including the plastics industry, said Pineda in the news release. Current low unemployment rates, such as the 0.1% unemployment rate in plastic and rubber products manufacturing in April, cannot be sustained indefinitely, he added, noting that the future trajectory of plastics equipment shipments will continue to depend on US macroeconomic conditions.

About the Author(s)

You May Also Like