BD to sell assets to disposable device maker Merit Medical for $100 million

Medical device manufacturer Becton Dickinson (BD; Franklin Lakes, NJ) has agreed to divest two of its product lines and related assets to Merit Medical (South Jordan, UT) contingent on the closing of BD’s proposed $24-billion acquisition of CR Bard Inc.

November 17, 2017

Medical device manufacturer Becton Dickinson (BD; Franklin Lakes, NJ) has agreed to divest two of its product lines and related assets to Merit Medical (South Jordan, UT) contingent on the closing of BD’s proposed acquisition of CR Bard Inc.

BD announced in April 2017 that it had entered into a definitive agreement to acquire CR Bard, which plays a leading role in the development and manufacture of vascular, urology, oncology and surgical specialty products, for $24 billion. The deal is expected to close by year’s end, subject to regulatory approvals.

|

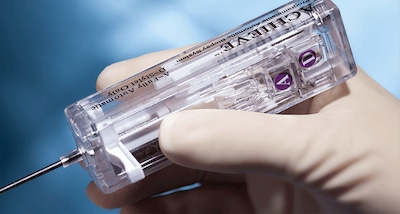

If the deal stands, Merit Medical will take ownership of BD's Achieve biopsy system. |

The assets that Merit Medical stands to acquire are soft-tissue core needle biopsy products currently sold by BD under the trade names of Achieve Programmable Automatic Biopsy System, Temno Biopsy System and Tru-Cut Biopsy Needles. The products are sold worldwide through a combination of a direct sales force and distribution partners, said Merit Medical in a press release.

The Aspira Pleural Effusion Drainage Kits and Aspira Peritoneal Drainage System, currently marketed by Bard, are also part of the deal. Merit said in the release that it understands these products to be currently sold primarily in the United States.

The purchase price for the product lines and related assets is pegged at $100 million.

Acquisition of the assets will complement Merit’s CorVocet biopsy system and bone biopsy products, according to medicaldevice-network.com. The transaction is expected to be accretive next year with estimated annual revenues of $42 million to $48 million.

“There are also a number of markets in which Merit has direct representation that will be expanded to include the acquired products, as well as new markets which we plan to develop,” said Merit Medical Systems Chairman and CEO Fred Lampropoulos in a prepared statement.

Merit Medical manufactures disposable medical devices used in interventional, diagnostic and therapeutic procedures. Its OEM division offers engineering, contract molding, packaging and labeling, coating and tube and wire processing services to medical technology companies.

BD said of the divestiture of some of its assets that it is another step forward in the regulatory review process of its planned acquisition of Bard. “We continue to expect that the BD and Bard transaction will close in the fourth calendar quarter of 2017, subject to customary closing conditions and additional regulatory approvals, including the U.S. Federal Trade Commission and other regulatory bodies,” said Vincent A. Forlenza, chairman and CEO of BD.

In other BD news, the company broke ground last month on what will be its flagship injection molding and manufacturing facility in Columbus, NE. It will spend approximately $60 million on the 69,000-square-foot expansion and upgrade of the plant, which BD wants to transform into “one of the largest and most sophisticated plastic molding plants in the world.” To learn more about this project, read “Medtech company BD builds one of largest, most sophisticated plastic injection molding plants in the world.”

About the Author(s)

You May Also Like