Congress passed a bill in June to offer up to $4500 to new car buyers who are trading in gas-guzzling clunkers for fuel-efficient models. The hope is to create a boost for U.S. car sales. A similar initiative for injection molders would be timely.Old injection molding machines should be a priority to be replaced. There are several reasons and the most obvious one is that oil and gas prices have resumed their climb and may hit $90/bbl by the time September comes around. Some economists project oil prices to again hit triple-digit levels sometime next year.

June 26, 2009

Congress passed a bill in June to offer up to $4500 to new car buyers who are trading in gas-guzzling clunkers for fuel-efficient models. The hope is to create a boost for U.S. car sales. A similar initiative for injection molders would be timely.

Old injection molding machines should be a priority to be replaced. There are several reasons and the most obvious one is that oil and gas prices have resumed their climb and may hit $90/bbl by the time September comes around. Some economists project oil prices to again hit triple-digit levels sometime next year.

|

All-electric machines are clearly the future: Sumitomo Demag Plastics Machinery GmbH in Schwaig, Germany, announced in late May plans to invest $71 million to expand manufacturing of all-electric molding machines. There are similar moves by other Japanese and German machine makers to boost output of such machines as global demand is anticipated to recover toward the end of this year.

Saving on energy costs is one critical element for injection molding plants. The challenge is figuring out how to pay for new, energy-efficient molding machines such as the flood of all-electric units displayed at NPE2009. How will molders be able to afford such massive capital investment at a time when bank financing remains difficult to obtain?

Right now there are no quick solutions beyond working with machinery suppliers. However, some state governments have started to offer incentives for manufacturing companies intent on saving energy. Every state has an energy office and while only a handful are currently offering incentives, we anticipate more will follow, especially in regions trying to stimulate business. Check here for a good list of what is available now.

If your state is not yet running an incentive program, take a moment to contact the energy office and ask if they are planning to include one in 2010. Remember that each state is able to apply for monies to fund “greening” under the economic stimulus package. Your phone call will help let the department know that there is interest in such a program and the response will help you in building your upcoming budget.

What’s on the horizon

The conviction that a third quarter recovery is imminent hardens across the manufacturing marketplace. The National Assn. for Business Economics Outlook projected in June that the second quarter will show a 1.8% annualized decline in the GDP, followed by increases in the balance of 2009. They surveyed 45 economists and more than 70% expect the recession will end by Q3 2009. The most pessimistic estimate was for the recession to end early in Q1 2010.

The rate of new unemployment filings dropped throughout May, but national unemployment rose to 9.4%. A record 14.5 million Americans are unemployed. The number of workers applying for federal benefits to extend the 26 weeks that most states offer gives an indication that those on the roles are not finding new jobs. National rates may climb as high as 11% before dropping to normal while the most severely affected pockets will hover at around 20% until early 2010.

Energy prices are going up. While some economists are projecting oil to hit triple digits per barrel by the end of the year, the Energy Information Administration remains optimistic. The agency expects crude oil to average $67/bbl for the second half of 2009, an increase of about $16 compared with the first half of the year. We are already seeing the evidence of price increases at gas stations across the country. The average U.S. price for regular-grade gasoline was $2.62/gal on June 8, almost $0.60 higher than its price at the end of April.

Regular-grade gasoline prices are expected to reach their summer seasonal peak in July, with a monthly average close to $2.70/gal. Gas prices are projected to average $2.56/gal in 2010 while the price of diesel fuel is expected to be $2.40 and $2.67/gal in 2009 and 2010, respectively.

Automotive

The pain for automotive molders continues. While U.S. new car sales were up in May when compared to April, they fell almost 34% in May 2009 compared to May 2008. Sales reached about 10 million units on an annualized basis.

GM and Chrysler are likely to eliminate more parts suppliers as they are set to close more assembly plants. The takeover of Chrysler by Fiat is unclear in terms of consequences for molders for now. GM’s bankruptcy is forcing many dealerships to close and will have a similar impact on parts suppliers. Major parts suppliers such as Visteon, which went into Chapter 11 in late May, will have to undergo major restructuring or fold. Many smaller suppliers that were already struggling for the past several years may be forced to close.

Trade

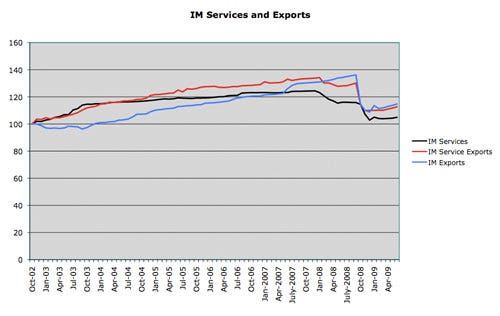

The April 2009 U.S. International Trade in Goods & Services report by the Commerce Dept.’s U.S. Census Bureau and the Bureau of Economic Analysis reveals the that U.S. exports decreased by 2.3% to $121.1 billion since March 2009. Imports decreased 1.4% to $150.3 billion. Overall, the trade deficit grew 2.2% during the same time period.

Manufacturing

The Institute for Supply Management’s manufacturing report for May shows economic activity in the manufacturing sector failed to grow in May for the 16th consecutive month, while the overall economy grew for the first time following seven months of decline. According to the Tempe, AZ firm, “While employment and inventories continue to decline at a rapid rate and the sector continued to contract during the month, there are signs of improvement. May is the first month of growth in the New Orders Index since November 2007, with nine of 18 industries reporting growth. New orders are considered a leading indicator, and the index has risen rapidly after bottoming at 23.1 in December 2008. Also, the Customers’ Inventories Index remained below 50 for the second consecutive month, offering encouragement that supply chains are starting to free themselves of excess inventories as nine industries report their customers’ inventories as ‘too low.’ The prices that manufacturers pay for raw materials and services continued to decline, but at a slower rate than in April.”

The ISM put the current PMI at 42.8, which is 2.7 percentage points higher than the 40.1 reported in April. This is the 16th consecutive month of contraction in the manufacturing sector. A reading above 50 indicates that the manufacturing economy is generally expanding; below 50 indicates that it is generally contracting.

A PMI in excess of 41.2, over a period of time, generally indicates an expansion of the overall economy. Therefore, the PMI indicates growth in the overall economy following seven months of decline, and continuing contraction in the manufacturing sector.

Real estate and money

After showing some signs of a turnaround in March, new home construction fell 12.8% in April to a 51-year low. According to the Commerce Dept., permits for new projects also hit record lows, falling 3.3% to an annual rate of 494,000. This means that molders still cannot find opportunities in the new home construction market.

Existing home sales rose in April, the third month of an increase. While we are seeing major banks loosen their credit restrictions on primary mortgages, the requirements are still high compared to just three years ago and the national average credit score is dropping. As more workers hit the unemployment roles, they are turning to their credit cards for emergency financing. According to TransUnion, one of the three major credit bureaus, the national average FICO score dropped 6 points from Q3 2008 to Q1 2009 and now averages at 651. TransUnion attributes the drop to an increase in credit card delinquencies, which is classified as users who fail to pay or meet the minimum monthly payment. In Q1 2009, credit card delinquencies hit a record high of 6.5%, while charge-offs reached 7.5%, a near-record high, according to the Federal Reserve.

Foreclosure filings fell 6% in May from April. More than 321,000 households received at least one foreclosure-related notice in May, 18% more than a year earlier. Many states and even some counties are offering free renegotiation plans to help homeowners reorganize their debts and stay in their homes under lower-interest, 30-year fixed loans. It behooves the local governments to keep these properties on the tax roles and we are beginning to see the positive effects as long-discussed plans go into action.

Agostino von Hassell is the president and Lisa M. Pellegrino is a senior advisor of The Repton Group LLC (New York, NY).

About the Author(s)

You May Also Like