India a flexible packaging land of opportunity, but caution required

A new report details the leaders in India's flexible packaging industry as well as helps processors to identify some of the opportunities the country offers them. According to the new report from PCI Film Consulting, India's flexible packaging market represents a $3 billion/yr market growing at a 15%/yr clip through 2015.

September 20, 2011

A new report details the leaders in India's flexible packaging industry as well as helps processors to identify some of the opportunities the country offers them. According to the new report from PCI Film Consulting, India's flexible packaging market represents a $3 billion/yr market growing at a 15%/yr clip through 2015.

|

The report, entitled The Indian Flexible Packaging Market 2011, highlights the opportunities but also cautions "businesses and investors need to understand the business environment before they can expect to be successful here."

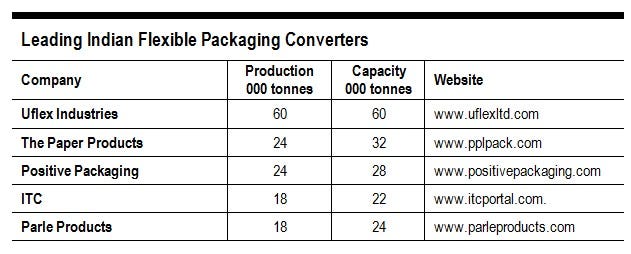

According to the authors, the report is based in large part on interviews conducted between March and July 2011 with Indian packaging converters and processors. PCI's report carries statistical analysis of trends in production, substrate usage and consumption, historical market drivers and expert forecasts, profiles of India's leading flexible packaging converters and analysis of and commentary on end-use segments.

The growth of the flexible packaging industry in India is being spurred, as most would guess, by the rapid growth of the country's middle (consuming) class. With a middle class the size of Europe, Indian consumers now have the purchasing power to match their counterparts in the West, and the Indian retail sector is rushing to satisfy them, note the authors. To date only 5% of food sold in India is packaged, with farmers' open markets still a major market force, but change is occurring rapidly.

According to PCI, the Indian packaging converting industry is two-tiered: serving the major food producers are converters producing European standard flexible packaging with equipment sourced from German and Italian equipment manufacturers. Outside the main commercial centers, there is a less organized market, with a large number of small converters producing flexible packaging of generally lower quality.

International packaging companies are almost missing, with Huhtamaki the only substantial player. Indian export trade in converted flexible packaging has been growing, according to PCI.

The report's authors argue that India's flexible packaging market will develop much differently than China's. "A bureaucratic and challenging political landscape, an increasing focus on environmental issues and the presence of established players, sometimes owned by the very manufacturers they supply, means that, while it may well be time to 'dip a toe' in the Indian market, there are still substantial hurdles to clear," explains PCI.

PCI Film Consulting's new report, The Indian Flexible Packaging Market 2011, is available here for €2250.

About the Author(s)

You May Also Like