Plastics pricing: Around the world, LDPE prices are all over the map

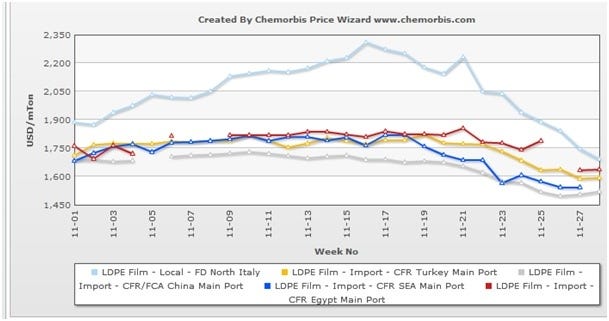

Using the two graphs with this article, processors of plastic packaging film can compare the price they pay to those paid by processors across the globe. The first graph illustrates pricing development this year for LDPE film grade material in four countries plus Southeast Asia. Upon seeing it the immediate response is, "Pity those poor extruders in Italy!"

July 15, 2011

Using the two graphs with this article, processors of plastic packaging film can compare the price they pay to those paid by processors across the globe. The first graph illustrates pricing development this year for LDPE film grade material in four countries plus Southeast Asia. Upon seeing it the immediate response is, "Pity those poor extruders in Italy!"

|

LDPE film extruders in Europe continue to pay a premium for film grade LDPE, but the difference has decreased. |

According to the chart, courtesy of plastics pricing service ChemOrbis, film extruders in Italy have been paying a healthy premium compared to those in Southeast Asia plus Turkey, Egypt and China, the other three countries for which the chart tracks LDPE film grade pricing. A second observation is that Chinese processors have had and still maintain a solid advantage on their principal cost versus their competitors elsewhere.

According to ChemOrbis, the price divergence between Italy and the other countries was due this year to limited availability for LDPE film grade material in Europe. The high €/$ currency exchange rate also contributed to the premium. Though Italy's (and Western Europe's) LDPE market still maintains its premium over other markets, the price gap has been narrowing since the end of May.

The steepest decline in European LDPE prices was seen this month. After prices for these plastics fell €90-100/ton in June, according to the ChemOrbis Price Indexes, film grade LDPE prices in Italy in July fell an additional €80-120/ton from the June level. In additon to lower feedstock costs, the price cuts stemmed from ample supplies and slow demand for these plastics across Europe.

After adding customs duties to the figures where applicable, ChemOrbis estimates that the USD equivalence of this week's spot LDPE film grade range for Italian buyers is around $100/ton above that in China and $50/ton above Southeast Asia on the low end.

|

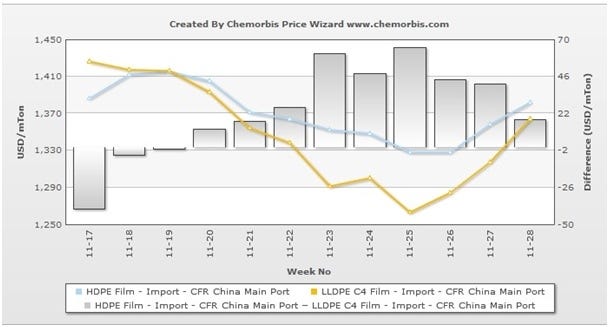

LLDPE prices in China are almost on a par with ones paid for film grade HDPE. |

The second graph, meanwhile, reveals ChemOrbis' take on pricing movement for import HDPE and LLDPE film grade plastics to China. Here, one sees that Chinese LLDPE film grade prices are moving close to par with HDPE film grade material. HDPE prices have been trading at a premium over LLDPE film material in China since the end of May as comparatively better demand for HDPE pushed the premium carried by HDPE film grade over LLDPE film as high as $65/ton in June.

LLDPE demand has picked up recently, however, reports ChemOrbis, as buyers have begun building up stocks ahead of the anticipated high season in the agricultural film market, which usually begins in August. Higher LLDPE futures prices as well as supply concerns stemming from a number of scheduled plant shutdowns inside China in the next few months have also contributed to the recent rally in LLDPE film prices.

According to data from ChemOrbis Price Index, spot LLDPE film prices on a CFR China, cash basis have risen by $80-110/ton during the past two weeks while HDPE film prices have registered relatively smaller increases of $40-70/ton over the same period.

About the Author(s)

You May Also Like