Overcapacity likely to remain status quo for PE, PP

Old plants never die, not when their costs have long been written off: that seems to be the rule among the polyethylene and polypropylene supply base. That and many other points were covered at the PEPP 2009 global congress on polyolefins, organized by Maack Business Services (MBS) in Zurich in October.

December 14, 2009

Old plants never die, not when their costs have long been written off: that seems to be the rule among the polyethylene and polypropylene supply base. That and many other points were covered at the PEPP 2009 global congress on polyolefins, organized by Maack Business Services (MBS) in Zurich in October.

In his presentation, Konrad Scheidl, executive VP and partner at MBS, emphasized the global shift in polyolefin production capacity. While 20 years ago close to two-thirds of all global polyethylene capacity was in Western Europe and North America, by 2015 it will be just one-third, and the regions will be major net importers. The Middle East, China, and Asia/Pacific will have tripled their share to almost half, although China will still be a net importer. And all the while, total capacity will have almost quadrupled. Data for polypropylene are quite similar.

|

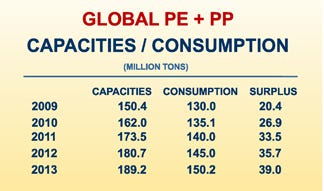

Scheidl pointed to the "surplus factor" as one key indicator of the polyolefin supply industry’s poor health. Surplus factor refers to nameplate capacity minus offtake, divided by nameplate capacity. A good surplus factor is 10, while 12 is sustainable, he said. According to MBS, though, it has been almost 20 years since a 10 was achieved in either the PE or PP supply chain. The indicator currently stands at over 20, and could almost hit 40 by 2013, Scheidl said. Capacities totalling almost 50 million tonnes/year are now at least 15 years old, and in some cases three times that, Scheidl noted. Their costs have been written off, and they could, theoretically, be shut down. “But sites die very slowly, if at all,” he noted.

Not only has supply continued to outstrip demand, but the location of that supply also has shifted, especially to the Middle East, and also China and other countries in Asia. As these new polymer production centers emerge and expand, there is a growing need for improved logistics to move materials around plants, to and from shipping terminals and to customers. This year, the conference devoted an entire session to the subject, with presentations from various players involved in the materials movement business.

Harald Wilms, business development VP at Zeppelin Silos & Systems, said that while the traditional model of polymer logistics has worked well within a single continent, where transport from the producer to the processor could be done in virtually a single operation (mainly by truck in Europe, more by train in North America), extended distances between source and user soon require additional elements such as distribution centres, as well as specialist service providers. With intercontinental shipment, this is the norm.

Wilms outlined various storage and transport technologies available to close the link between the polyolefin producers and their clients in the downstream compounding and conversion industries. Discussing intercontinental shipment by bulk carrier, he said that with increasing capacities of polymer plants, their focus on few commodity grades per plant, and the export of these polymers to distant locations, new concepts may become economic in the future. “Any container ship can only be filled to a maximum of 2/3 with polymer containers,” he said. This problem can be overcome by using bulk carriers, similar to those known for bulk cargo shipments of grain or coal or minerals.

Toon Bruining, group supply chain & marketing director at InterBulk Group, agreed that market developments are forcing the polymer industry to review existing supply chains. Over-capacity and volatile markets call for agile supply chains that are cost- and cash-efficient, he said. He also noted that multiple stock locations and divided responsibility for inventory management further increases stock levels.

The PEPP 2010 conference will be held again in Zurich on June 14-15, 2010. —[email protected]

About the Author(s)

You May Also Like