The Hedging Corner: It’s all about margin – Part I

Ask different risk managers the primary purpose of hedging and you will get different responses depending on portfolios and company objectives: cost control, budget and forecast certainty, job and business security, competitive advantage, customer loyalty, etc. However, in my opinion, for most manufacturers, the primary purpose of hedging should be to secure and improve profit margins.

May 17, 2011

Ask different risk managers the primary purpose of hedging and you will get different responses depending on portfolios and company objectives: cost control, budget and forecast certainty, job and business security, competitive advantage, customer loyalty, etc. However, in my opinion, for most manufacturers, the primary purpose of hedging should be to secure and improve profit margins.

Unless a manufacturer has very patient investors, is government subsidized, or has some other unique business arrangement, manufacturers need to turn a profit, and do so reliably. With regards to hedging, this means controlling costs consistent with the way revenues are generated; i.e. the timing and type of hedges for cost control reflect the timing and nature of sales, and v.v. This is just common sense (e.g. lock in costs against fixed price sales; cap costs against floating price sales; etc.), but common sense in hedging is often violated, even by experienced hedgers, and sometimes with disastrous results.

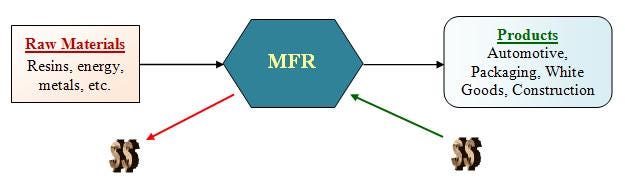

Consider this schematic of a generic manufacturer where Product Margin = Sales Price - (Raw Materials + Manufacturing) Cost:

Plastics processor margins

The manufacturer risks weak or unprofitable margins due to high raw materials (commodities) costs that may not be recoverable for strategic, competitive, or other reasons in the sales price of its products. Sometimes taking this risk pays off; other times it does not. In either case, the manufacturer is speculating on profit. (Ironically, many manufacturers think the exact opposite - that hedging, particularly hedging margin, is speculative. Perhaps that's one of the reasons why so few manufacturers have risk-management programs. It's certainly a reason why many are struggling.)

What is your margin risk and what are you doing to manage it? Are you among the processors who are reluctantly raising prices to maintain profits, despite resistance from customers? (See this discussion on PlasticsToday.) Or are you just hunkering down, hoping resins prices move lower, expecting to outlast your competitors? Neither of those situations is necessary with a hedging (risk management) program in place, focused on securing and improving margins.

Processors who manage margin risk will outperform and outlast competitors because they have more time to focus on meeting the needs of customers in the highly competitive market for plastics devices and less time worrying about costs and revenues.

Much more to follow on margin risk management, including discussing ways to increase revenues and make customers happy at the same time.

About the Author(s)

You May Also Like