U.S. is shaking up the global PE market

The U.S. development of shale gas continues to look bright. According to a recently published study by industry consultants Applied Market Information Ltd (AMI Consulting), among the factors that will significantly impact the growth of PE film usage as well as the level of global trade in finished film will be shale gas development in the U.S.

February 28, 2014

The U.S. development of shale gas continues to look bright. According to a recently published study by industry consultants Applied Market Information Ltd (AMI Consulting), among the factors that will significantly impact the growth of PE film usage as well as the level of global trade in finished film will be shale gas development in the U.S. This will lead to major reduction in the cost of PE resin in addition to reducing the energy cost of subsequent film production.

AMI Consulting claims that it is highly probable that North America will have a polymer cost base on a par with that in the Middle East, leading to PE film exports from North America overtaking those of the Middle East. Looking beyond 2018, this projected cost advantage, when combined with the technological expertise of U.S. polyethylene film producers, will ensure North American PE film producers become truly global players.

Other factors that will have an impact on the growth of PE film production will be the continuing investment in export-oriented regions such as the Middle East and Southeast Asia, and the growth of middle classes in less developed global regions. However, AMI Consulting noted that the global marketplace will feature "real winners and losers."

Other factors that will have an impact on the growth of PE film production will be the continuing investment in export-oriented regions such as the Middle East and Southeast Asia, and the growth of middle classes in less developed global regions. However, AMI Consulting noted that the global marketplace will feature "real winners and losers."

In 2013, Northeast Asia (including China) was the highest producer region with one-third of global production of PE film, followed by NAFTA with a 17% share and Western Europe accounting for 15% of global production. By 2018, it is forecast that Northeast Asia will have increased market share of global production to over 35%, while NAFTA's share will remain unchanged and Western Europe's share will fall significantly, largely as a result of continuing economic difficulties in some of the member states combined with high costs of raw materials, energy, labour and freight.

Western Europe will continue to grow in terms of tonnage only because it remains one of the cradles of technical development of PE films (the other being NAFTA) and continued success will depend on a shift of business towards higher added value film products. Meanwhile the Middle East will increase its market share by growing production at over 10% per year, making it the fastest-growing global region in percentage terms. Inter-regional traded volume has grown significantly over the past few years to reach over 3 million tonnes per year, with Northeast Asia and Southeast Asia jointly accounting for over half this traded volume. An additional half million tonnes per year is forecast to be traded by 2018, driven by increased volumes of film on the reel rather than bags and sacks, which will decline as a result of environmental initiatives in several global regions.

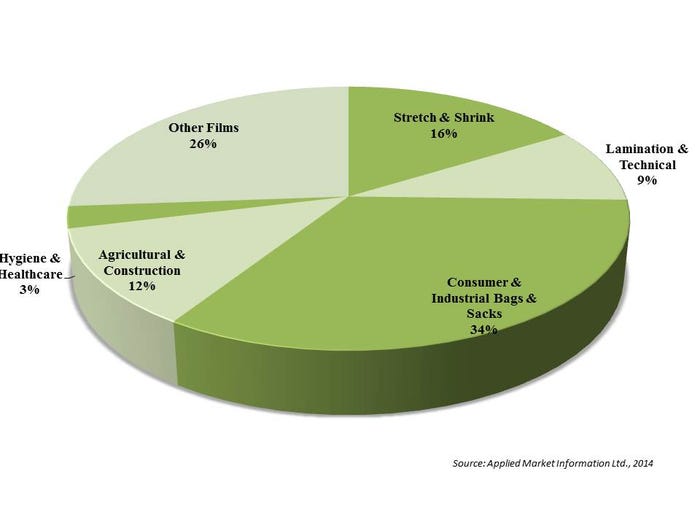

Looking at market applications, the highest growth rate is forecast for stretch films on the back of increased usage is less well-developed countries as the proportion of sales through large retail outlets increases. Demand for bags and sacks is also forecast to grow appreciably, as is growth of technical films, agricultural films, heavy duty sacks and shrink films. In terms of individual resin types, LDPE will continue to decline in market share as processors adopt usage of more sophisticated linear resins in increasingly complex formulations, resulting in market growth of metallocene and higher alpha-olefin LLDPE grades.

Study shows potential economic impact for West Virginia

It looks like West Virginia is ready to take full advatnage of the U.S. shale gas advantage. The presence of an ethylene cracker and associated polyethylene plants would be a catalyst for even more investment, revitalizing the chemical industry in West Virginia and the region, according to a new study.

Construction would have an economic impact of more than $2 billion in West Virginia, with ongoing operations driving more than $110 million in annual employee compensation and more than 2,000 permanent jobs during the life of the facility. Downstream investments in end-use polyethylene converter plants could create more than 900 additional jobs and $280 million in annual output, according to a study by Tom Witt.

facility. Downstream investments in end-use polyethylene converter plants could create more than 900 additional jobs and $280 million in annual output, according to a study by Tom Witt.

Witt, Chief Economist at Witt Economics LLC and a Professor Emeritus at West Virginia University, on Tuesday presented his study, Building Value from Shale Gas: The Promise of Expanding Petrochemicals in West Virginia, to the Legislature's natural gas caucus.

Witt's study is based on a theoretical investment of $3.8 billion in an ethane cracker and associated polyethylene plants, with an additional $150 million in pipeline infrastructure, $20 million in on-site ethane storage, and $20 million in rail and truck terminals.

Several petrochemical investments have been discussed in the Appalachian Region, including one in Wood County, W. Va., currently being evaluated by Odebrecht.

Witt noted that there is a need for infrastructure in this region, which is key to the success of the ethane cracker and PE plants.

"Building an ethane cracker and associated PE manufacturing facilities is a watershed economic opportunity for the state and region. This opportunity would expand a high-value manufacturing industry that creates high-wage jobs, new technologies, and the prospect for expanding downstream plastics industry investments," according to Witt. "A strategic effort on the part of the state and local government to promote the physical and social infrastructure required for a renewed local petrochemicals industry would be a signal to investors that the state looks to once again become a serious player in the U.S. chemicals manufacturing sector. Without it, these high-value raw materials would find alternate markets."

Click here for a more in-depth look at how the fossil fuel revolution can impact a community.

About the Author(s)

You May Also Like