Report highlights recovery of injection molding machine sales

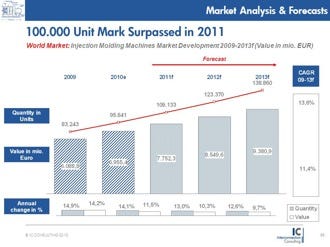

The worldwide injection molding machine market quickly recovered from its collapse in 2009 with a market growth of 14.2% in terms of value in 2010. While countries in Western Europe saw relatively moderate demand growth rates of up to 8%, the booming regions of Eastern Europe, Eastern Asian and Latin America experienced growth rates of up to 27.2%, according to a recent study from market research outfit Interconnection Consulting.

October 17, 2011

The worldwide injection molding machine market quickly recovered from its collapse in 2009 with a market growth of 14.2% in terms of value in 2010. While countries in Western Europe saw relatively moderate demand growth rates of up to 8%, the booming regions of Eastern Europe, Eastern Asian and Latin America experienced growth rates of up to 27.2%, according to a recent study from market research outfit Interconnection Consulting.

|

The total worldwide market for injection molding machines will see an annual growth rate of 15.5% between 2009-2013, according to the report's authors. The driving forces behind this positive trend are molders' demand in Eastern Europe, China and Latin America, with growth rates of 23.1%, 19.4% and 21.5% respectively.

Similarly high growth rates appear in India (18.1%), Northern Europe (14.1%) and Southern Europe (11.7%). All other regions also have a positive market growth, France & Benelux being the region with the lowest growth - a still very positive 6.8%.

Medium-size machines have the highest share

The majority of revenue within the injection molding machine market is generated by machines with a clamping force of 1001-5000 kN of clamp force. In terms of value of machines sold, these mid-sized presses account for a share of 53.4% of the total market's value, followed by small machines (clamping force below 1000 kN) with a share of 30.2%.

The remaining 16.4% belong to large machines with a clamping force greater than 5000 kN. This distribution will barely change in the coming years. In Central Europe the share of machines with a clamping force of 1001-5000 kN is especially high with 67.1%, whereas machines with a clamping force below 1000 kN have their highest share of 44.7% in China. The small machines are especially needed in China because of the massive size of the market there for production of goods that need less technologically advanced machines.

Electric and hybrid machines are gaining ground

Saving energy is a goal of almost every molder, and that goal helps drive machine sales. As a result, injection molding machines with an electric or hybrid drive, which are expected to save up to 70% of energy compared to conventional machines with a hydraulic drive, attract more and more attention and demand. Fully 30.7% of all machines sold in 2009 had an electric drive, and 6.1% had a hybrid (hydraulic/electric) one. These shares will rise up to 33.3% and 7.2% respectively in 2013.

Electric injection molding machines are especially popular in Japan & South Korea and in North America, with shares of electric machines in this regions amounting to 70.2% and 50.5% respectively.

Automotive more important than packaging

Back in 2009 36.7% of all injection molding machines sold were used to process packaging. In 2010, however, the share of the automotive field increased from 35.8% in 2009 to 36.2%, pushing packaging down to second place. The medical field will gain importance as well in terms of market shares: The share of machine sales expected to go towards processing of medical parts will develop from 12.0% in 2009 to 13.6% in 2013. Other fields of application will have combined shares of slightly more than 15% through the next years.

New market entries expected

Especially in the booming regions of East Asia and South America new competitors are expected to enter the market. Long-established European and American injection molding machine manufacturers will have to face decreasing prices caused by these new entrants. The established companies should lay their focus on machines that require advanced technology and are more energy-efficient

The report Injection Molding Machines Worldwide 2010 is available from Interconnection Consulting for € 10,888. The report is divided into coverage of 12 regions. It is possible to purchase coverage of some regions separately. Prices of these single region reports range from € 2950 to € 4950. The regions available separately are: Total Europe, USA & Canada, China & Taiwan, India, and Japan & South Korea.

Interconnection Consulting employs 20 analysts in office in Vienna, Austria.

About the Author(s)

You May Also Like