Inflation Pressures Weigh on Plastics Supply Chain

Polyethylene and recycled polyethylene supply chains can’t seem to buy a break, and even if they could, they’ve probably already spent everything on gasoline.

April 13, 2022

Apologies for the terrible joke, as inflation is hardly a laughing matter for those grappling with how to deal with escalating costs for raw materials and logistics as well as long lead times, let alone everyone coping with higher costs at the grocery store and the pump.

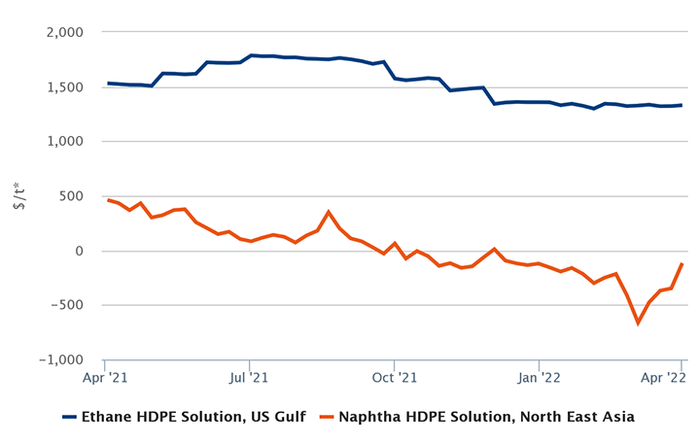

The entire plastics supply chain is straining under the weight of higher prices. Yes, even US producers of polyethylene (PE), who on the surface are still enjoying outstanding margins due their advantage of making resin from ethane feedstock. That source has not risen in price anywhere near the rate of crude oil or its derivative naphtha, which much of the rest of the world uses to make PE. That’s led to variable margins for integrated PE producers to look like that shown in the chart below from ICIS Analytics, which compares robust US high-density PE (HDPE) contract margins to those in Northeast Asia, which has been trying to crawl out of the red. It has not been profitable of late to make HDPE in Northeast Asia, although higher prices for HDPE and co-products emanating from naphtha cracking are starting to help.

Still, US PE producers are not singing as joyful tune as you might expect, as logistics constraints are making it difficult to export resin to regions such as Asia, South America, and Europe. ICIS analysts estimate that less than 40% of US production is being exported monthly. That number needs to be in the 40-45% range to keep US domestic PE inventories from piling up, but with up to 80% of export bookings heard to be delayed, warehouses are quite full. That could lead to lower operating rates for US PE plants in the coming months if container shipping logistics don’t get better. Based on the last year’s numerous shipping issues, it’s hard to bet on that occurring.

There is little respite from higher pricing in recycled PE (R-PE aka rPE) either, and ICIS’s launch of weekly R-PE coverage comes at an appropriate time for that nascent market. As noted recently by my colleague Senior Recycling Editor Emily Friedman, several grades of US R-PE are facing increased demand as buying interest remains undeterred by global market uncertainties. Everything from mixed colored R-HDPE to natural R-HDPE bales remain in high demand, with natural resin pellets maintaining a premium to virgin pellets of the same grade.

The US R-PE market is not as developed as the recycled polyethylene terephthalate (R-PET aka rPET) market, but one difference that has evolved with R-PE is that cost sensitivity plays an important role, leading to most grades closing trailing virgin PE and wide-spec pricing. R-PET has matured to the point of decoupling from virgin PET, although continued strong demand from brand owners with ambitious sustainability targets means that detachment has led to higher prices than for virgin material.

If consumer demand remains strong, this period of strong pricing seems likely to persist in most commodity resin markets. But never forget that, historically, the cure for high prices has been high prices. With wage growth not keeping pace with inflation, consumers’ wallets will eventually not be able to support price escalation. Let’s hope that if that happens there are not severe economic consequences that hurt consumers and the plastics supply chain.

Jeremy Pafford, head of North America market development, drives ICIS’s business development strategy for the US, Mexico and Canada and represents ICIS to chemical and polymer markets to showcase the company’s expertise. Pafford draws upon extensive experience in leading engagement efforts by the Americas team over the last several years.

About the Author(s)

You May Also Like