3D Printing Trends to Watch in 2024

Increasingly fulfilled technological promises coupled with uncertainty in industry restructuring will mark the year ahead.

At a Glance

- Freedom of design as a scalable production reality is the way ahead for 2024

- In additive manufacturing, companies like HP are focusing keenly on sustainability initiatives

- More end-use applications — final products, bridge production, and spare parts availability — will come to market

Sometimes a new year promises “out with the old, in with the new.” In 3D printing, though, that often translates to out with the old promises, in with the fulfillment of potential. Additive manufacturing (AM) has been an industry full of promise, with its base 3D-printing technologies compared more often to sci-fi tropes like Replicators than recognized as manufacturing-grade technology. It could just be that, finally, 2024 is the year we see more realization and fewer sci-fi comparisons.

The biggest trends we can predict for 2024 in 3D printing are realizable promises and uncertainty in industry restructuring.

Promises fulfilled

The single greatest trend ahead �— and, granted, this isn’t the first time we as an industry have hopefully put this on our New Year’s bingo cards — is that the promises of AM will be fulfilled.

Those promises are many and tend to boil down to a few big-picture capabilities:

Freedom from design constraints (i.e., “complexity is free”);

less waste (sustainability);

faster prototyping-to-end-product (faster time-to-market);

localized production (on-demand).

Others often make headlines, but those are some of the highest-profile promises. In turn, they have become some of the highest-profile disappointments as they have largely remained unfulfilled in terms of mass manufacturing.

So how will 2024 move the needle? What will be ahead for 3D printing?

Complexity is free

Often phrased as “complexity is free,” one of the major selling points of 3D printing is the removal of traditional manufacturing constraints in terms of design/geometric complexity. New forms and shapes can be created in a single build that is only possible in the layer-by-layer processes of 3D printing — no molds, no milling.

Algorithmically engineered heat exchanger. Image courtesy of Hyperganic.

Design for additive manufacturing (DfAM) is already a rising discipline in which CAD creations are made specifically for the given 3D-printing technology chosen to best leverage its production capabilities. Whether a powder bed fusion (PBF) or fused filament fabrication (FFF) process is used will impact how a design must be made, from supports to post-processing to final product. This isn’t where the news is.

Freedom of design as a scalable production reality is the way ahead for 2024.

The thread tying together the new year’s promises in AM is production. Complex prototypes are a current reality, already cutting down on design cycle time. When it comes to mass manufacturing, though, AM has long been losing the race.

While AM is not currently poised to unseat injection molding for mass production, end-use production in targeted arenas is on the rise. Complex parts in demanding industries like aerospace, defense, and automotive are already being created. Parts are in the skies on aircraft, as well as in space on the International Space Station (ISS), that can only have been made via 3D printing processes, and more and more Department of Defense contracts are going to AM companies. Racing teams are relying on parts-on-demand that lightweight more aerodynamic vehicle bodies.

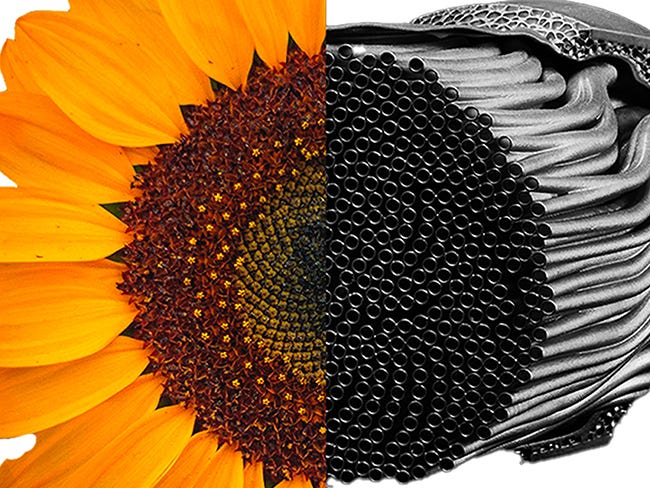

Complex designs like heat exchangers also offer ample opportunity for nature-inspired design to be within reach.

Sustainability, not greenwashing

The world is focused on sustainability, and again we’re looking to move away from greenwashing to true impact. Less waste, lower material usage, lower energy consumption, end-of-life recyclability, carbon neutrality — the routes to sustainability planning in manufacturing are many.

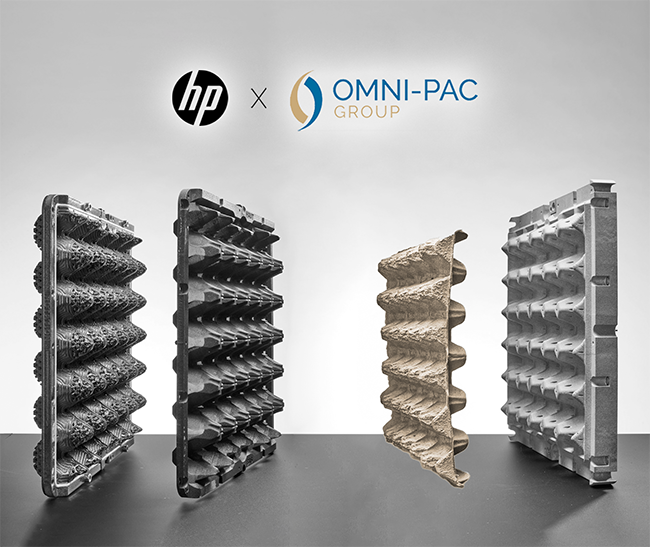

HP x Omni-Pac Group imagery highlights the intersection of 3D printing and molded pulp packaging. Image courtesy of HP Inc.

In additive manufacturing, companies like HP are focusing keenly on sustainability initiatives.

As Mariona Company, global head of fiber-based sustainable packaging, HP Personalization and 3D Printing, explains in an exclusive comment:

“Sustainability is not a new trend, but while 75% of companies worldwide have made commitments to sustainable packaging, less than 30% are well prepared to meet their targets. Changing our approach to packaging by shifting away from hard-to-recycle and harmful materials is a meaningful way to advance sustainable impact, helping companies deliver on commitments, address consumer expectations for more environmentally friendly products, and maintain compliance with a growing list of global regulations.

“In order to truly manufacture sustainably, products must be designed with environmental impact front of mind from the very start. 3D printing is a key enabler of the trend toward digital manufacturing for a more sustainable future because of its ability to create a circular economy and accelerate design innovation and optimization. One example is molded fiber, an eco-friendly and biodegradable alternative to plastic packaging that traditionally has been costly to manufacture. Recent advances to HP’s Molded Fiber Tooling solution make it possible to make more complex geometries and reduce the weight of packaging by up to 10%. Additionally, 70% of manufacturing offcuts can be re-used during the manufacturing process, making it a far more environmentally friendly alternative to traditional plastic packaging.

“3D printing and key industry partnerships will continue to break down barriers and make access to molded fiber manufacturing better than ever before, pioneering a new era of sustainable packaging solutions capable of high-quality designs that complement brand aesthetics.”

In this intersection of advanced manufacturing with a high-impact industry — packaging — the impact of partnership and reach comes squarely into play.

Faster time-to-market

AM has come a long way from its RP roots, as the technology suite was initially known as rapid prototyping for its foundational application. Faster prototypes mean faster final products, which remains a major underscore in the value proposition for 3D printing.

More end-use possibilities are coming to market, though, in terms of final products, bridge production, and spare parts availability. Time-to-market means both new designs and reduced downtime through faster deployment of spare and replacement parts, as 3D printing answers the calls of market needs.

While this particular promise of 3D printing has in some ways been fulfilled from the start, offering speedier entry routes to availability, 2024 is poised to push the envelope. More applications, more availability, more customer awareness, and more materials portfolios are set to expand the scope of what “time-to-market” can mean as AM expands its reach and furthers its adoption.

On-demand production

Nearly a decade ago, the world was captivated by headlines claiming that NASA emailed a wrench to space. That’s true, in a way, as the Made In Space team overheard ISS astronauts wishing they had a specific tool on hand, and the CAD file sent up enabled them to print it on the onboard 3D printer.

The headline and its takeaway highlight the beauty of on-demand production: Get what you want where and when you need it.

Closer to Earth, this promise is being fulfilled more regularly via additive manufacturing. Production facilities operating the same equipment with the same materials can ostensibly make exactly the same part from the same file on different continents. That’s a reality today, and is becoming more remarkable the more adoption rises. Engineers in Singapore can email a file to their colleagues in Dubai and share it with those in Silicon Valley, with each able to hold up the same finished part on a team Zoom chat.

This particular promise is a maturing one, as it is already in evidence — so its inclusion on this list is a pleasant reminder that AM is already within reach.

Industry reshaping

The first patents for 3D-printing technologies as we know them today were filed in the 1980s. The processes don’t look like they did 40 years ago, and the industry itself doesn’t look anything like it did back then. While some big pure-play AM companies have decades of operating history — think 3D Systems, Stratasys, EOS — most are newer kids on the industry block.

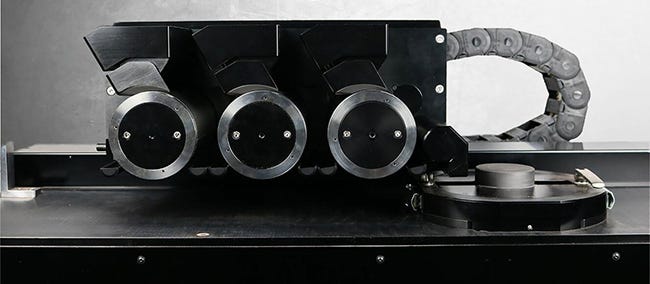

The re-coater technology of Schaeffler Aerosint SA offers enormous commercial potential for Schaeffler Special Machinery and extends Schaeffler's technology expertise in additive manufacturing. Image courtesy of Schaeffler.

Industry restructuring has been an ongoing process, with 2023 particularly facing some upheaval and subverted expectations. In particular, the failed merger of 3D Systems and Stratasys built up and then collapsed a full reshaping of the top of the pure-play public companies. It’s also notable that those first patents from the 1980s belong to these companies, which originated fused deposition modeling (FDM; Stratasys) and stereolithography (SLA; 3D Systems) technologies that remain mainstays of today’s 3D-printing world.

While the 3D Systems/Stratasys news was the biggest of the year, it was the billboard for larger trends, as well as the headline for dramatic failures-to-close for its own larger saga. Stratasys also almost acquired Desktop Metal. Nano Dimension placed several failed bids to acquire Stratasys. After all that, both primary players in the saga have announced restructuring plans, with Stratasys divesting one of its metal parts-making facilities as well as a urethane facility.

In the midst of all of this, of course, global conditions are impacting business. Stratasys, Nano Dimension, and other major 3D-printing industry players have their headquarters and significant operations in Israel. The ongoing war in Israel since October naturally has a major effect on companies with personnel in the area. Nano Dimension, for example, initially announced operations as usual, but has since canceled its extraordinary shareholders general meeting (EGM) planned for December 2023.

Like COVID-19 before it, the current wars — including the ongoing atrocities in Ukraine — force companies to adjust and adapt to unforeseen circumstances in which employee, partner, and customer lives are at stake.

Mergers and acquisitions (M&A) remain a significant focus, with 2024 surely promising more restructuring to come.

Given the uncertainties in global conditions, few forecasts can be made even as 3D printing remains critical to humanitarian and defense efforts like those seen in Ukraine, Gaza, and other war-struck locations.

Other M&A activities continue, with 2023 for example having seen significant moves like BigRep first acquiring HAGE3D (pdf) then announcing a SPAC move to go public (pdf); Nexa3D acquiring Addifab, XYZ Printing’s SLS business, and Essentium; 6K Additive acquiring Global Metal Powders; Schaeffler Special Machinery acquiring Aerosint; GoEngineer acquiring Rapid PSI (pdf); Align Technology acquiring Cubicure; ADDiTEC acquiring Elem Additive Solutions; and restor3d acquiring Conformis. Upcoming moves in the making include the likes of voxeljet considering strategic alternatives that include but are not limited to mergers and acquisitions and joint ventures.

So, will 2024 be the best year yet in 3D printing? Let’s consider instead: Isn’t every year?

Happy 2024, technology!

About the Author(s)

You May Also Like