Automotive Tooling Barometer shows shift from slow start to recovery

Die and mold tool shops express a positive outlook as on-hold work dips.

October 28, 2016

The Original Equipment Suppliers Association (OESA; Troy, MI) and Harbour Results Inc. (HRI; Southfield, MI,) recently completed their Automotive Tooling Barometer containing data from Q2 2016. While the industry experienced a slow start to the year, with more than $2 billion in tooling capacity not leveraged during the first quarter, it has since taken a turn in the right direction. Not only have capacity utilization rates stabilized for die (83%) and mold (76%) tool makers in the fourth quarter, overall work on hold has decreased by six percentage points since January. HRI estimates the on-hold impact to industry in the second and third quarters to be around $1.6 billion, a decrease from more than $2 billion in January.

Not only does the research show industry recovering from a downturn, but shops also are expressing a positive outlook about business in the coming months. Year over year, the tooling sentiment index has experienced a 32% change, with sentiment now up eight points since January to 74. HRI’s analysis of the survey results revealed the cyclical nature to sentiment, as there is some level of correlation to the amount of work on hold reported.

“Automotive forecast data shows the industry can expect to see a significant increase in tooling during the next two years,” said Laurie Harbour, President and CEO of HRI. “Although the average price per tool is down, it is important that shops increase quoting to maintain revenue and meet demands.”

“Automotive forecast data shows the industry can expect to see a significant increase in tooling during the next two years,” said Laurie Harbour, President and CEO of HRI. “Although the average price per tool is down, it is important that shops increase quoting to maintain revenue and meet demands.”

Mold and die shops reported an increase in tools shipped, averaging a 16% overall increase from 2014. Mold shops saw a 4% increase in revenue per tool. Additionally, the research assessed sales and marketing activities within the tooling industry and found that sales efficiency and quoting levels varied greatly by tool shop revenue. Larger shops demonstrated greater levels of efficiency, with shops over $20 million earning 22% more revenue per salesperson and quoting 32% more per estimator than shops under $20 million.

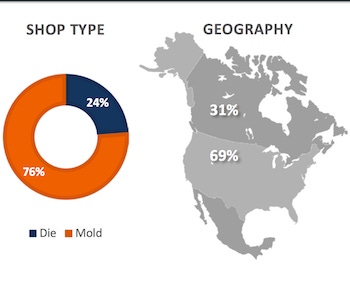

The Tooling Barometer collected insights from a diverse group of shops with a total of more than $1 billion in tooling revenue across nine different industries. Although 82% of responses came from automotive, HRI deems this to be a good reflection of the overall industry, as the automotive industry accounts for a majority of the tooling industry’s revenue.

On Nov. 10, 2016, OESA and HRI are hosting the 2016 Automotive Tooling Update, a meeting where automotive tooling market intelligence and insights, as well as an in-depth analysis of current tooling practices and trends, will be shared.

The OESA Automotive Tooling Barometer survey series was created by the OESA Tooling Council with the partnership of Harbour Results Inc. to provide an indicator of the current state of the automotive tooling industry and perception of near-term prospects for the industry. The OESA Automotive Tooling Barometer captures the sentiment of the major companies in this market. A full copy of the September OESA Automotive Tooling Barometer results is available on the OESA website.

Harbour Results Inc. is a business and operational consulting firm for the manufacturing industry offering operational and strategic advisory expertise and proprietary assessment programs to help optimize performance. Focused on small- to medium-sized manufacturers, many of which are family owned or privately held, HRI uses its knowledge, experience and relationships to build upon the established foundation with sound strategies and operational improvement.

About the Author(s)

You May Also Like