Moldmaker adapts to automotive winds of change

May 27, 2002

|

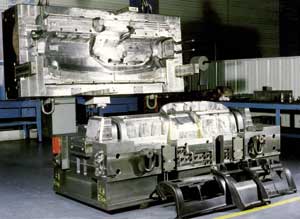

Apart from making large molds, the Sermo Group says it too must be big (and global) to match the consolidation and globalization of the entire automotive business. |

In 1966, Claude Nerriere started what is now the Sermo Group believing two things: Industrial and automotive applications for plastic would increase; and such industry in France would not remain concentrated in the south of the country. He was right on both counts. The automobile industry grew near Sermo's headquarters in western France and the company began to specialize in that market in the 1970s. At the last Euromold fair in Frankfurt, Nerriere and Managing Director Didier Crespel laid out Sermo's strategy for dealing with more recent changes in the automotive supply business.

The trends Sermo is working with now are concentration, specialization among suppliers, and globalization of the entire business. Through it all, Sermo's goal is to be the leading European supplier of molds for large auto assemblies like front ends, bumper groups, and instrument panels. However, all of this requires having facilities outside Europe. This was triggered by concentration, says Crespel, and is typified by mergers like DaimlerChrysler and Renault-Nissan that in turn pull suppliers to new countries and continents.

|

Though very visible, bumpers and other body parts are only about 30 percent of Sermo's output. Almost half its molds are for internal car components, and the rest are for under the hood. |

Meanwhile, automakers are making cars more sophisticated and higher performing. Also, the model life cycle of cars is decreasing. The result is fierce pressure for cost reduction to pay for all the models and features therein. Specialization, says Crespel, has become necessary for the suppliers to compete. Moreover, as the primary suppliers concentrate on core business, moldmaking is transferred to secondary suppliers—and the associated design, development, and testing that goes with it.

Specialize, Globalize, Grow

Moldmakers in Europe have generally been small to medium companies. In France, for example, Crespel says only three moldmakers have revenues of more than 20 million euros ($19 million). Sermo's turnover is about 65 million euros. This money is needed to meet customer demand for cost reduction, globalization, and increased services.

With both Tier One and OEM companies expecting moldmakers to globalize along with them, the resource needs rise even faster. Sermo has already started to spread itself out. The company has more than 630 employees, of whom more than 90 are involved with mold design. In addition to the two manufacturing facilities and the tryout center in France, Sermo opened a factory in Poland in 1996 that now has 170 employees. In 1998, it opened Sermo do Brasil to provide tools for European automakers there. That facility now employs 65. Another factory is currently coming online in India, and there are design/service centers in Germany and England. The company also has working partnerships with Matriceria Austral in Argentina and Delta Tooling in the U.S.

|

Sermo's multiple locations allow high-tech production in some facilities, like this one in France, and simultaneous use of low labor costs in its Polish and Indian plants. |

Besides facilities to supply large multimold assemblies and the financial support it requires, Crespel says quality and time/cost reduction are the other critical elements to success in this market. Sermo has ISO 9000 certification in most of its facilities and is working on the others. The factory at the Saint-Hilaire headquarters is QS 9000 certified and is being recertified to ISO 9001:2000. A program of continuous improvement generated by the workers is in place, and 250 improvement ideas have been submitted in the last six months. Nonconformance management, automatic inspection, and project-specific action plans are also among the quality tools Sermo uses.

The list of Sermo's locations is proof of the company's effort to mix low-cost locations with high-tech factories in Europe. The former keeps costs low on small to medium molds and relatively simple molds. The latter uses technology such as high-speed machining centers to reduce time in both the design and manufacturing phases of large and/or complex tooling. Having outlined all that, Crespel finishes by emphasizing that the moldmaking business is still one of expertise. Sermo has an ambitious program of staff improvement as well as profit sharing and participation schemes to keep its employees' skills and motivation at the top of the class.

Contact information |

You May Also Like