October 21, 2021

Despite what recent headlines reported, not everything is getting more expensive, and purchasing managers in the plastics supply chain need to make note of that.

Oh, labor and production costs for end-products remain elevated, but prices for key resins such as polyethylene (PE) and polypropylene (PP) in the US market are at the beginning of what should be a long period of decline. Not far behind them should be US polyvinyl chloride prices (PVC), which seem to have peaked at current record-high levels due to Hurricane Ida’s impacts on Louisiana where as much as 60% of US PVC capacity was affected.

The reasons for these impending declines have been written about extensively by me and the analysts at ICIS and Chemical Data, but at the forefront is the return to normal production and inventory levels after months of depletion and manufacturing challenges.

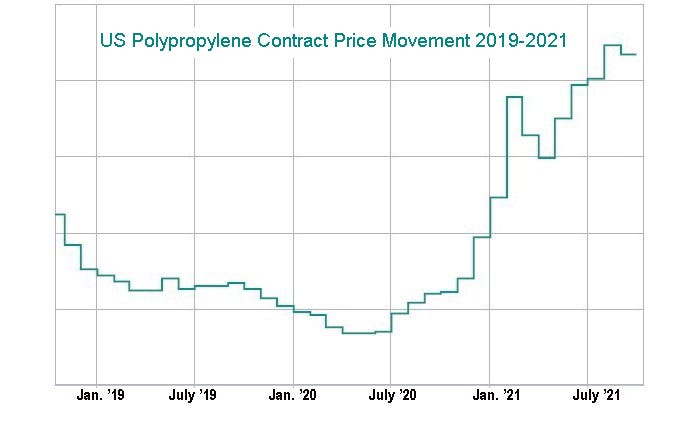

For markets such as PP, imports of much cheaper Asia-produced resin are having an impact as well. US PP imports have more than doubled this year compared with 2020, with South Korea, Singapore, and Taiwan among the top suppliers. August saw North American PP inventories at their highest levels in more than a year and days of supply on hand back to normal levels of around 33.2. Add in falling upstream propylene prices, and the rollercoaster that has been the following US PP contract price graph is set to tilt downward.

But how severe that tilt for PP, PE, PVC, or other resins ends up being in Q4 and 2022 depends as much on you and me as it does another freak Gulf Coast freeze or production mishap.

We consumers have proven resilient during the pandemic in our demand for goods made from plastic. Many have been buoyed by Covid-19-related federal stimulus and boosted unemployment benefits. But those wells are drying up, and amid significant, continued price inflation on energy, goods and services, US consumers are poorer than they were a year ago.

Wages in September grew 4.6% year on year, but prices increased 5.4% year-on-year as well. The dollars we make from work aren’t stretching as far as they did before, and there is less stimulus in the system. Add in higher costs for a vast majority of purchases and difficulties even getting some things due to supply-chain kinks, and you have a recipe for a continued downtrend in consumer confidence.

The US consumer can lead the economy into a recession just as easily as it kept the Covid-19 downturn relatively brief, and the warning signs are growing in that direction. Should that occur, a downturn in demand for plastic products could mean a precipitous drop in resin prices that could lead parts of the supply chain sitting on higher-priced material that it cannot move at a price it can recoup its costs from — a situation that isn’t good for anyone. Worse yet would be a deflationary environment where buyers stay on the sidelines today thinking that prices will be lower tomorrow, only to repeat the thought process when tomorrow comes. We have seen that before during collapses in crude oil, and history does have a way of if not repeating at least rhyming.

This isn’t a prediction that the bottom is going to fall out of resin markets, but it is a call to take that possibility into account in your planning for 2022. Have a plan for what your company would do should the US economy tank just as you would one in which you forecast the US economy to surge in a post-Covid recovery. Regardless of how consumer confidence tracks, you can be confident in your business’ ability to weather whatever conditions arise.

Jeremy Pafford, head of North America market development, drives ICIS’s business development strategy for the US, Mexico and Canada and represents ICIS to chemical and polymer markets to showcase the company’s expertise. Pafford draws upon experience in leading engagement efforts by the Americas team over the last several years.

About the Author(s)

You May Also Like