Making Shale Gas Profitable When It Isn’t

Low prices don't have to mean low-to-no profitsOutlook for Natural Gas PricesPersistently high shale gas production keeps a lid on prices while the floor creaks

October 3, 2013

Low prices don't have to mean low-to-no profits

Outlook for Natural Gas Prices

Persistently high shale gas production keeps a lid on prices while the floor creaks

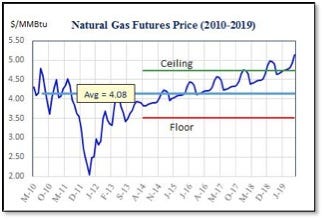

The shale gas boom has busted natural gas prices below $4 per MCF until 2016, risking sub-$3.50 in the meantime, particularly in the shoulder months. (Note: 1 MCF = 1.02 MMBtu.) At $3.50 per MCF, shale gas production is barely profitable, if at all, for some producers. Shell Oil, for example, just announced they're abandoning Eagle Ford in south Texas even as Mexico provides a demand relief valve. If Shell Oil can't profit on shale gas at $3.50, how well can other producers be doing? Is their gas much cheaper to produce? If so, it's not by much.

Natural gas future prices

Can most gas producers hold on until demand for natural gas catches up to supply in 2017 and prices finally break over $4.50? Do they have to - or is there something they can do in the meantime to avoid a "cut losses" decision like Shell's? As the title of this post suggests, the answer is "Yes" - and not change a thing they're doing operationally.

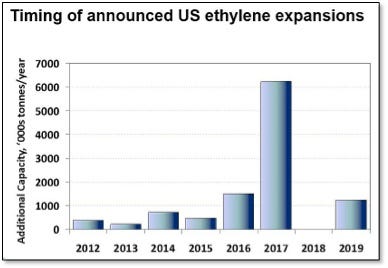

Smart producers can capitalize on the possibility of higher prices today. They need not wait for 2017 when futures prices indicate they should be high enough to be consistently profitable thanks to spiking industrial demand (see ICIS information below) and higher demand from electric utilities, LNG exports, and natural gas-fueled vehicles. (For demand forecasts by sector, see the EIA's Market Trends - Natural Gas.)

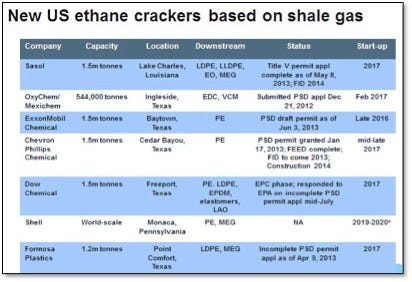

ethane crackers

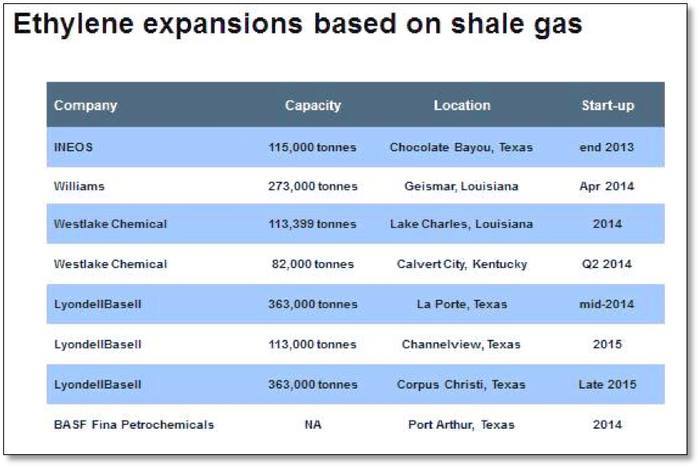

Ethylene expansions

Ethylene expansions schedule

Source: ICIS Shale Gas Report by Joseph Chang, Global Editor, ICIS Chemical Business

[Aside: If shale gas is unprofitable to produce, will the cheap and plentiful supply that petrochemical companies are counting on for their ethane and ethylene projects be available?]

For producers, capitalizing on the possibility of higher gas prices means selling insurance. Although natural gas prices are hardly as volatile as they used to be, they are volatile enough for some buyers to consider buying protection (insurance) against higher prices - as I recommended petrochemical manufacturers do in Keeping the Edge, Part 2.

How can producers find those insurance buyers? Happily, they don't have to - the futures market delivers them, anonymous and credit-worthy.

Steps to Profits until 2017

For producers to make their shale gas profitable (or more profitable), here are some simple steps:

1. Open a futures account and fund it in accordance with your production volume and risk.

2. Obtain authorization to sell call options. (Authorization to buy put options is essentially automatic.)

3. Choose strike prices based on your market price expectations and profit requirements.

4. Sell call options at those strike prices for any and all months through 2016.

5. Consider buying protective put options in the shoulder months to eliminate downside price risk when the risk is highest.

Hold until expiration of the options contracts or close them prior to expiration to take profits early and possibly re-execute.

Examples

Month | Price | Call Strike | Premium | Put Strike | Premium | Net Premium |

Jan 2015 | 4.22 | 4.50 | 0.33 | |||

May 2015 | 3.96 | 4.25 | 0.30 | 3.50 | 0.20 | 0.10 |

Jan 2016 | 4.37 | 4.75 | 0.36 | |||

May 2016 | 4.05 | 4.50 | 0.39 | 3.75 | 0.30 | 0.09 |

Too bad Shell Oil didn't execute this strategy or something similar before spending so much money on Eagle Ford and then abandoning it. If you're a shale gas producer, you can be wiser and more profitable than Shell. Don't just wait for 2017.

About the author: Tom Langan is an energy and petrochemicals risk management consultant dba WTL Trading. He helps buyers and sellers of commodities control costs, secure profit margins, and increase revenues. Articles helpful to resins buyers and sellers are chosen from Tom's Hedging Corner blog and posted on Plastics Today.

About the Author(s)

You May Also Like